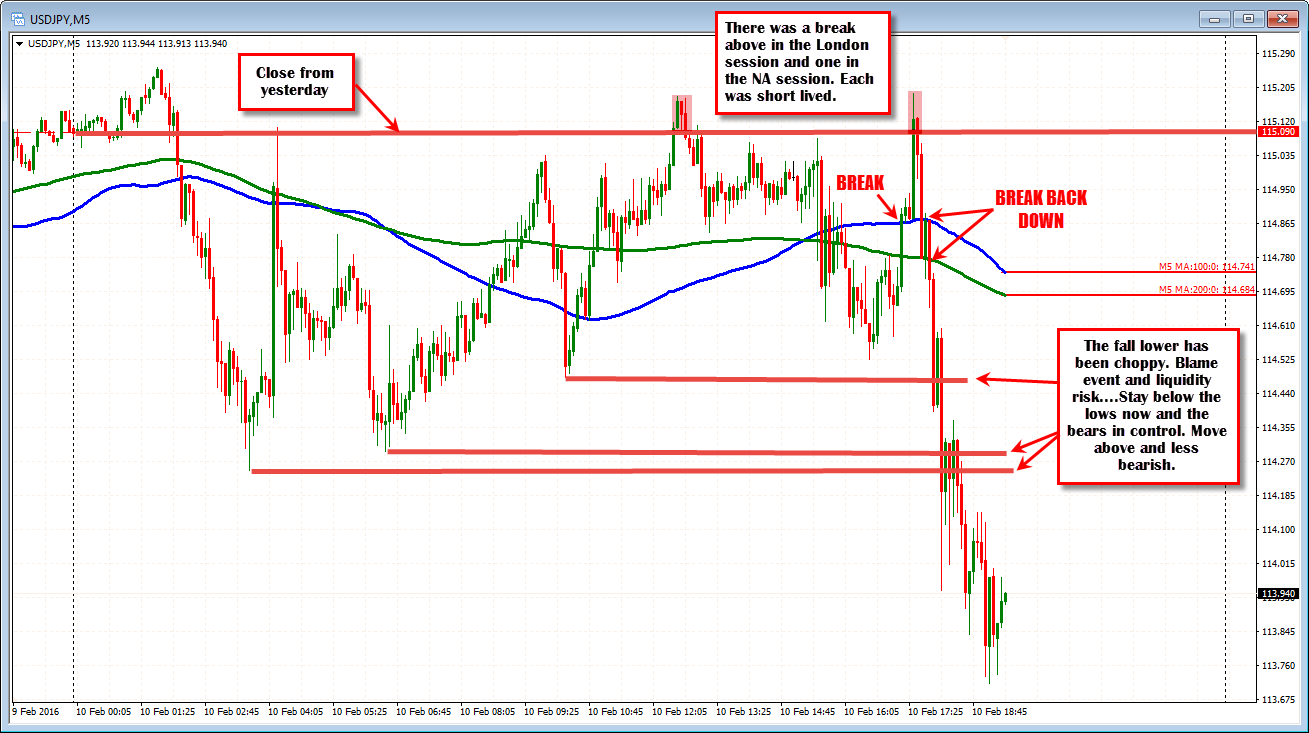

Whip and then back down

I wrote earlier that the 115.09 closing level from yesterday, would be eyed today (CLICK HERE) and perhaps the 100 and 200 bar MAs on the 5-minute chart as close risk. Well, the price did move above the 100 and 200 bar MAs (see chart below) and even went above the 115.09 level. Like the move in the London morning session, the time above was brief. This time, it came in the midst of the Yellen testimony where event and liquidity risk help contribute to the "whip".

The price break failed and that fits with the longer term break yesterday below the 115.55-116.00 area from the daily chart. The bears remain in control. However, even with the decline from the high, there is more choppiness in the trading. Chalk it up to the increased risks from the Yellen testimony.

Overall, however, the sellers/bears remain in control. The price is below the earlier lows at 114.25 and 114.30 and below the low from yesterday at 114.19 and 114.31. These swing lows from the last few days remain as ceiling levels to eye. The midpoint of the move lower comes in at 114.45 and staying below that level would also keep sellers happy (although more nervous).

On continued weakness, the next targets look at a lower trend line at 113.58 and 50% of the move up from July 2014 (it is where the trend higher started to go higher) at 113.455 area.

Yelllen continues to testify which keeps the markets on edge.

S&P is up 1.01%. Nasdaq is up 1.69%.