Tried to break lower yesterday. FOMC statement ruined those plans.

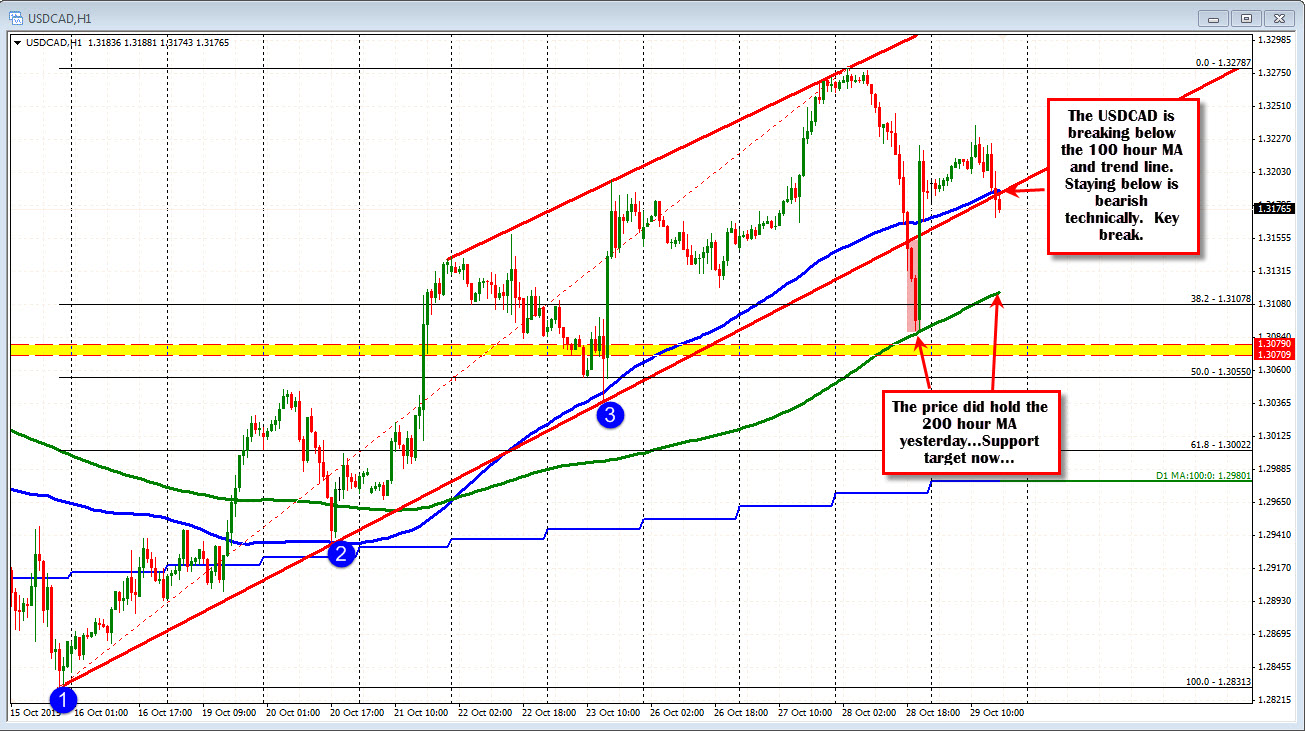

The USDCAD has closed below the 100 hour MA (blue line in the chart below), and the trendline connecting lows going back to October 15 at 1.3189-91.

Now I know the price fell below that trend line and below the 100 hour moving average, in yesterday's trade but the line was a strong one, the break below was quickly reversed on the FOMC statement, so keeping the line in place is ok. Whether you like that or not, the price is below the 100 hour MA.

Staying below should keep the sellers engaged. ON the downside, there is support at the 200 hour MA (at 1.3115). Note that the low yesterday stalled at that MA level (admittedly helped by the FOMC). That will be a key target IF the price can first stay below the aforementioned technical levels just broken. Crude oil is up 1.7% in trading today.