Slower Wholesales trade sales and lower oil help but only to a point

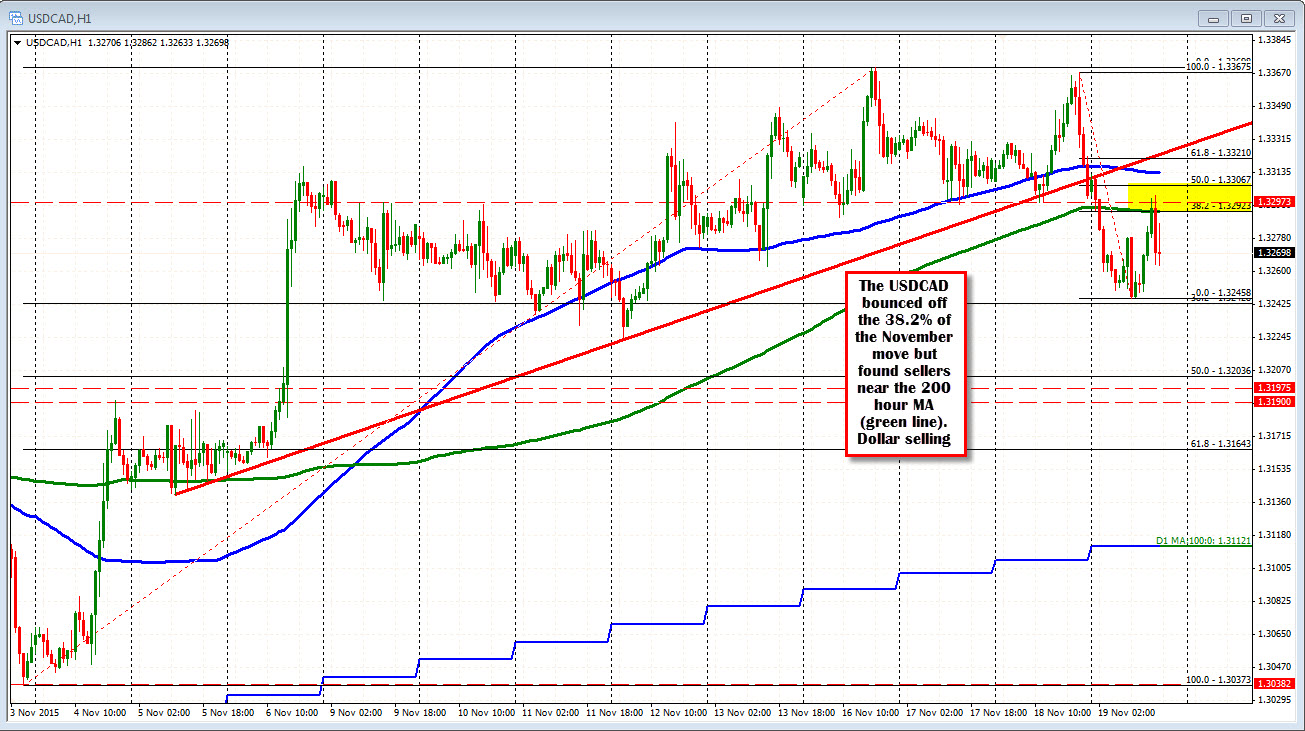

In Canada today, slower wholesale trade sales and lower oil prices helped to lower the CAD (higher USDCAD), but the price could not get and stay above the 200 hour MA nor move above the 50% of the move down from yesterdays post FOMC minutes high (at 1.33067). The US dollar weakness has taken hold and is helping to push the pair back lower.

The pair has moved below the 100 hour MA, trend line support, 200 hour MA since yesterday's high. On the downside, the 38.2% of the move up from the November low did find support buyers. This is the next key target on the downside. Needless to say retaking the 200 hour MA and the 100 hour MA are the keys for the buyers. Right now, the focus is on the dollar weakness.

Oil prices did move to a low at 39.89 today. That took out the low from yesterday at 39.91 by 2 cents, but for the 2nd day, the price has bounced back higher. So there is some reluctance to go too far below the level.