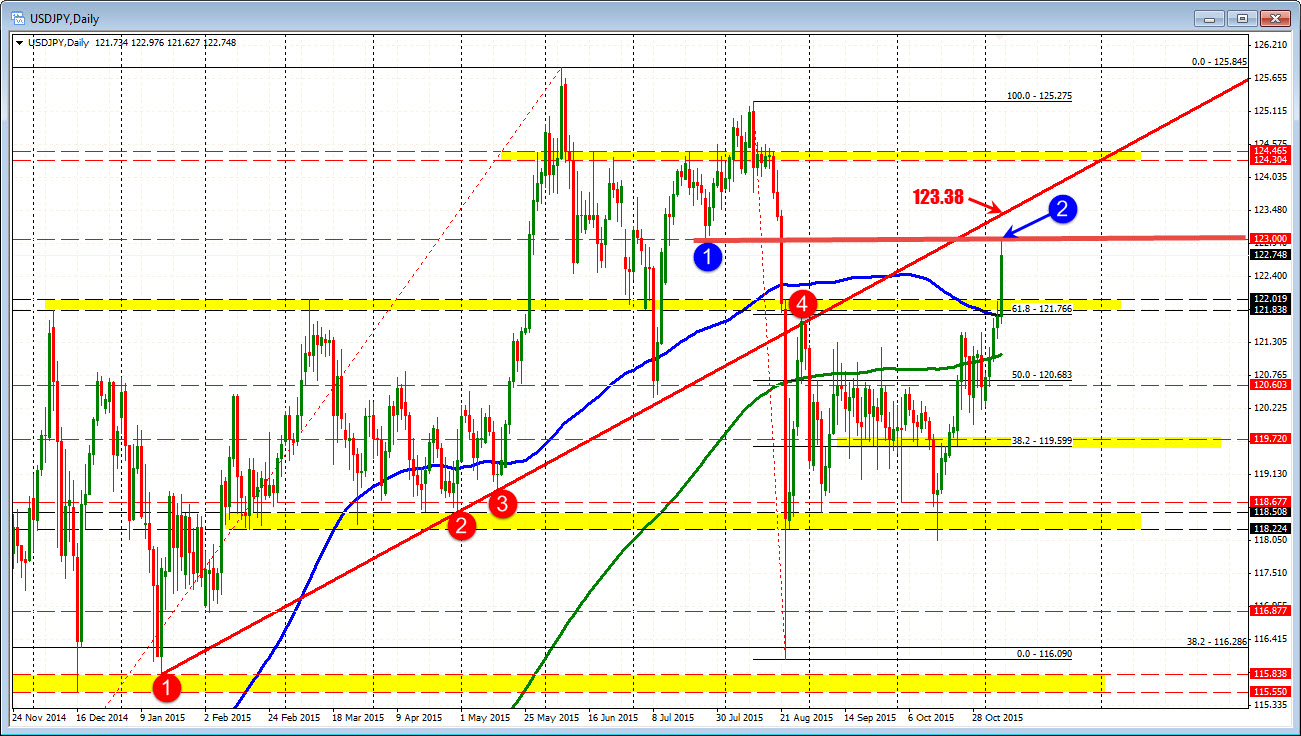

Tests July 27 swing low.

The USDJPY has surged higher on the back of the better than expected US jobs report. The pair moved up to a high of 122.97 - just short of the natural 123.00 level. The low price from July 27 came in at that 123.00 level. A move above this level is the next upside hurdle from a technical perspective. A break above will then look toward the underside of the broken trend line at 123.38.

Looking at the spike higher, the traders who bought after the release paid near highs. The holding below the 123.00 level has led to a 44 pip correction. Traders get offsides if they trade on the spike. The correction has found buyers against the 38.2% at 122.54. THe 50% of the move comes in at 122.407. Traders will look for buyers against this area on dips (risk defining level now). Stay above and then get through the 123.00 level and all is right with the bullish move. The next target is 123.38.

Break below 122.407 level (50%, and all the buyers up in the post number region, get (more) nervous.