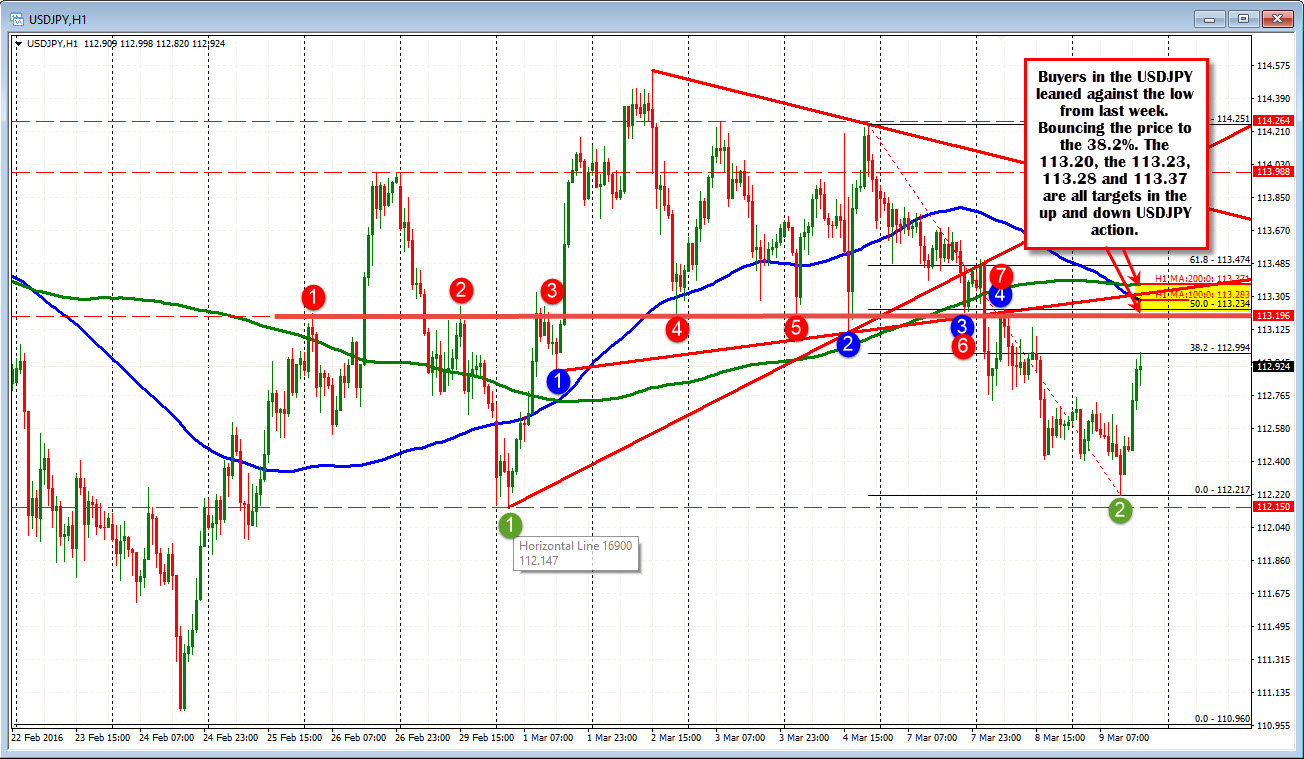

Looks toward cluster of resistance

The USDJPY is getting a boost with the overall better dollar tone. Stock prices are higher (S&P up 0.59% and trading at the highs). Bond yields are also higher.

Technically,the pair found the support buyers near the low from last weeks trading (112.15 low. Today's low reached 112.22). The pair moved below trend line support, a floor area, and the 200 hour MA in trading on Monday and Tuesday. Those are now topside resistance targets starting at 113.20 (see red circles). The 100 hour MA is at 113.28. The 50% is at 113.23. The 200 hour MA is at 113.37 currently. That would be the area to likely see a cause for pause at least.

The pair over the last few weeks - really last month (see a wider view below of the same hourly chart). Traders will probe for extremes.. With the holding of the low from last week, the extremes seem more defined now between 112.15 and 114.26. The 113.20 area is in the middle. Buyers from below will likely look to the cluster to take intraday profits (or some). If we get through the "land mines". that should trigger some potential momentum back up to the upper extreme.