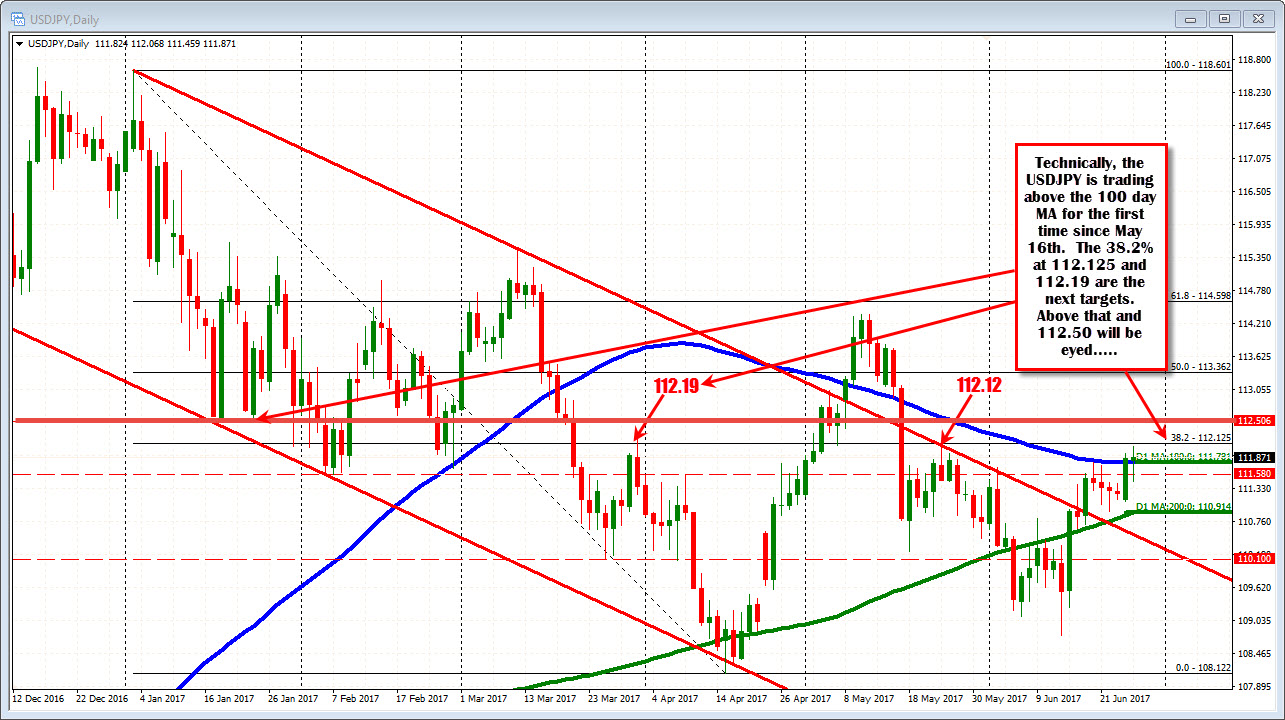

The 112.125-19 is the next target (if it can stay above the key MA)

The USDJPY traders are testing the "air" above the 100 day MA. The first look (started in the NY afternoon yesterday), saw the price dip back below in the late Asian/early European trading. The price has moved back above the 100 day MA for the 2nd time over the last few hours. The price has stayed above but the high from earlier today at 112.066 has not be approached. The break has not failed (it is not shaded red like the first break), but there is some work to do. If the price moves back below the 100 day MA (and the 111.71 level - bottom of yellow area), the buyers should liquidate on the failure. So far, however, I give the benefit of the doubt to the buyers against that old ceiling level.

Looking at the daily chart below, the 112.125 is the 38.2% of the 2017 trading range. There was a spike high at the end of March at 112.19. Those are the next targets. Above that and traders will be looking toward 112.50. The 50% of the years trading range is up at 113.36. That would be a stretch today, but if the price is able to stay above the 100 day MA, it would become a viable, next target.