Stocks ahead...

The USDJPY tumbles lower as stocks tumbled lower (the year of the Yen?). The Pavlovian reaction is the bell rings as stocks falter and the JPY pairs move lower.

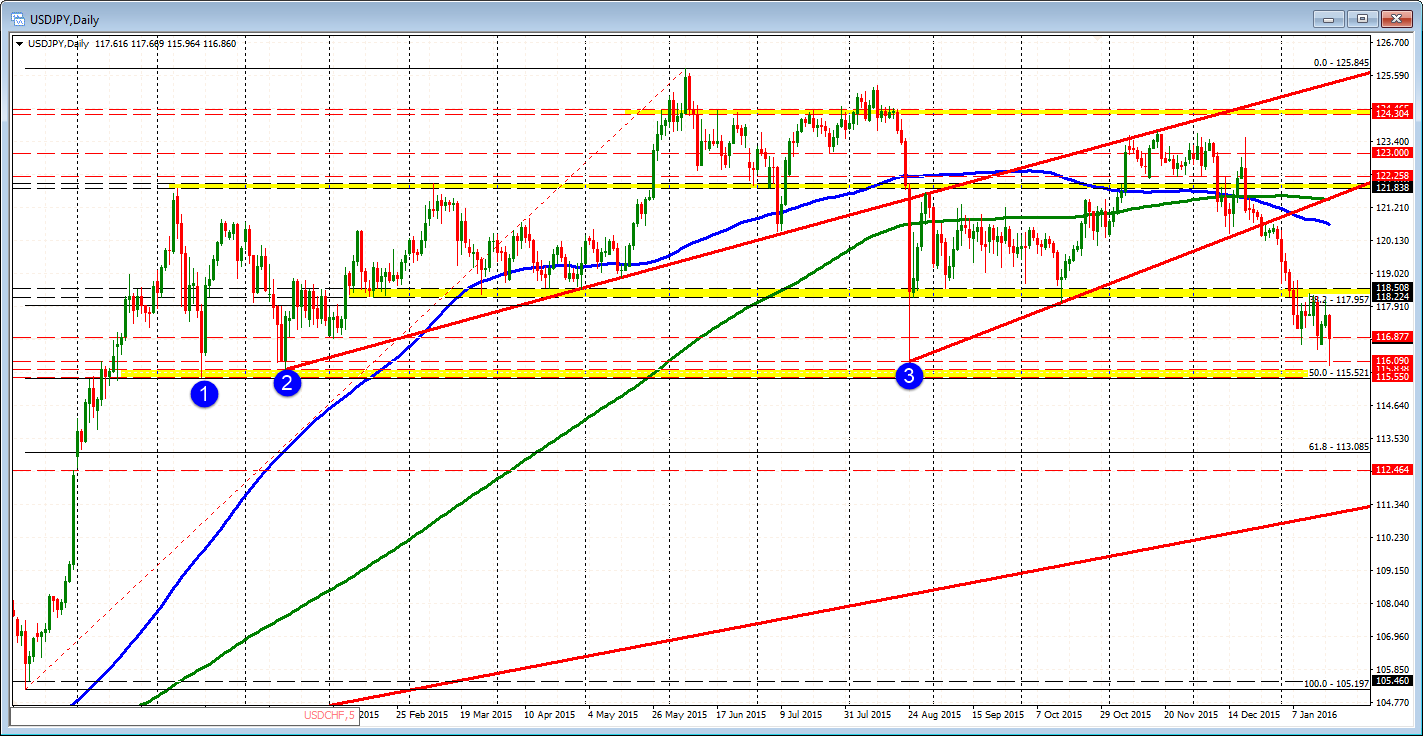

Technically, the pair had help from holding below the 200 hour moving average at the start of the trading day (green line in the chart above). That was the kick. The intensity increased as the 117.17 level was breached (see yellow area - there were swing lows in that area). The last few hours have seen a quick exhaustion at the 116.00 area. There were some low trend lines on the hourly. On the daily chart below, the low from August bottomed at 116.09.

The snap-back bounce has taken the price to the 38.2% retracement of the move down from the high yesterday at the 116.783 level and also above the lows from Jan 8 and Jan 15. The European stocks are off the lows (Dax only down 2% vs -2.5% when I started the day). Traders now wait for the US stock market opening.

For traders the road will likely remain full of pot holes, especially with stock market uncertainty. Technically, a rally toward 117.03-18 should find sellers happy to lean against resistance. A move below 116.50 should (low from Jan 15) should lead to another test of the key support below.