The small fundamental positives are all adding up to lift the pound

Yesterday it was the draft UK/EU deal that helped the pound out. Today it's the services PMI. None of it was huge news that changes the current landscape regarding BOE monetary policy but put enough small bricks together and you start to build something bigger. Throw in some dollar weakness and we see why the upside is the path of least resistance right now.

That is until we hit some bigger levels. 1.4440 has been the topside so far this month and it went today. We're seeing that confirmed with a hold at 1.4435/40 and then at 1.4450

GBPUSD 15m chart

They're not hugely strong confirmations but for intraday players and scalpers they mark an important area.

The price isn't running away with any real conviction right now. It's pushing and pushing but in small steps. One of the reasons for that is the next batch of resistance around 1.4465/75

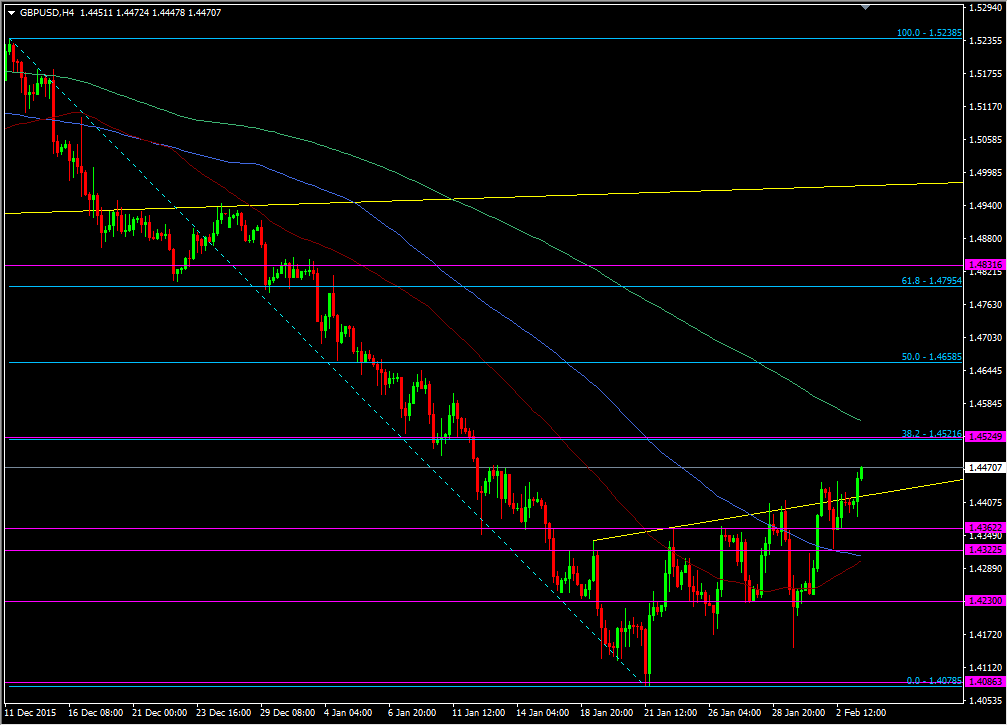

GBPUSD H4 chart

That resistance comes from the 12/13th Jan where the price held after breaking 1.4500 (and we've gone through it as I type, so watch for signs of it becoming support)

And that takes us to the next band of resistance at 1.4500/20-30. If you cast your minds back, this was a strong level of support I traded when we first touched it. As it was strong then, I'm looking for it to be a strong-ish resistance level also. It should certainly be a test for the first attempt and I'd imagine there would be some stops just above 1.4530 from those who sold the break through 1.4500.

Whatever happens, it's a level to keep an eye on. If we go through it then I'd be looking for it to become support again. However, be wary if we break 1.4500 but not 1.4530.