Gold technical analysis:

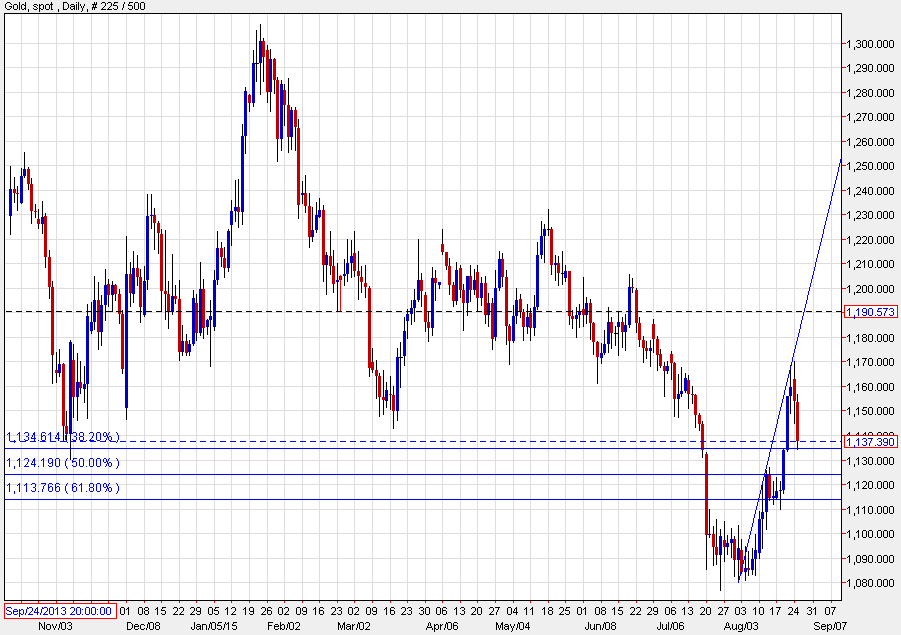

Gold has given back 38.2% of its rally since the beginning of the month as the US dollar stabilizes and worries about a currency war abate.

Gold touched as high as $1170 on Monday but fell later and the day and continued another $17.53 lower to $1137 today.

The low of the day of $1134 almost perfectly matched the 38.2% retracement of the July 23 low of $1076 to yesterday's high.

The highs were fractionally above the 100-day moving average but today's fall takes it below the 55-dma at $1140.

Support is at the November low of $1130 and the mid-August high of $1127.

What's the gold trade?

Markets remain in a state of deep uncertainty and but gold hasn't been able to take advantage. I expect the next leg will be determined by the Fed. If Dudley (wed) or Fischer (fri) deliver dovish speeches then gold is likely to rally.

However, the technical from here point to a period of consolidation from current levels to $1160 before a fresh, sustained move.