Mixed closes for the major European indices

The major European indices are closing mixed with modest changes. The snapshot of provisional closes shows:

- German DAX, -0.1%

- France's CAC, +0.2%

- UK's FTSE 100, +0.3%

- Spain's Ibex, -0.2%

- Italy's FTSE MIB, +0.2%

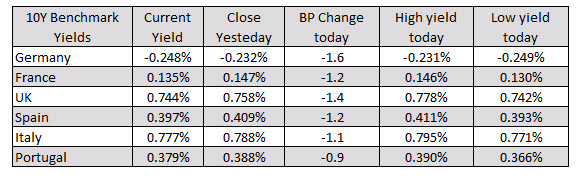

In the European debt market, the benchmark 10 year yields are all down around -1 to -1.6 basis points.

In other markets as London/European traders look to exit:

- Spot gold is trading down $0.56 or -0.03% at $1858.46.

- Spot silver is up nine cents or 0.36% $27.76

- WTI crude oil futures are up $0.77 or 1.07% at $72.89. The price reached a new cycle high of $72.99

- Bitcon is trading down -$1158 or -2.9% at $38,797

in the US stock market, the major indices remain mixed:

- S&P index -1.5 points or -0.04% of 4245.20

- NASDAQ index +12.3 points or 0.09% at 14085.20

- Dow -26.02 points or -0.07% at 34274.61

IN the forex, the NZD remains the strongest while the CHF means the weakest but each are off their extreme levels.

The ranges for the major currencies vs the US remain contained and narrow. The USDCAD at 21 pips, the EURUSD at 25 pips, and the USDCHF at 24 pips are particularly confined but all are well below their 22 day averages ahead of the FOMC decision at 2 PM.

In the US debt market, the yields are down less than 1 basis point with the 2-10 year spread near unchanged. The 10 year yield remains below 1.500% level at 1.487%.