The kiwi advances further in European morning trade today

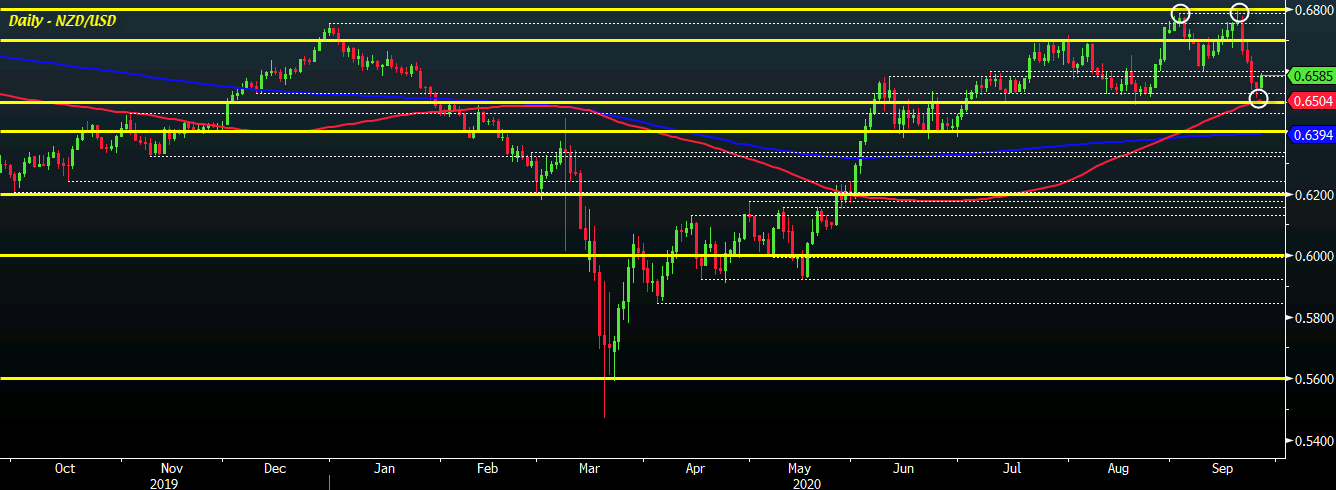

NZD/USD is pushing higher on the day towards 0.6600 currently, following a modest rebound in North American trading from a low of 0.6512 to close at 0.6546.

The bounce comes after price action moved close to testing the 100-day MA (red line) but also as the dollar is seeing its gains on the week moderate a little.

On the latter, that is more of the case today as well with EUR/USD inching towards 1.1685 and GBP/USD rising back to 1.2800 in European morning trade.

As for NZD/USD, the bounce is encouraging but buyers have more work to do.

The 100-hour moving average for the pair comes in @ 0.6609 with the 38.2 retracement level of the recent swing move lower @ 0.6621 to pose added near-term resistance:

Keep below the 100-hour MA (red line) and the near-term bias will stay more bearish. Hence, the slight retracement higher over the past few sessions isn't quite leading to a significant shift in sentiment just yet.

Looking ahead, the dollar side of the equation remains the most intriguing part.

The greenback has been pushing gains throughout the week as equities are also seen stumbling a little. But amid yesterday's breather, we'll have to see how things play out towards the closing stages of the week.

If equities and risk suffers another major setback, that could easily turn the tide around for NZD/USD to head lower.

But on the flip side, if the dollar fails to follow through on the moves from earlier in the week, then perhaps there is scope to switch towards a push higher.

In that regard, be mindful of EUR/USD and the 1.1700 handle. A switch back above there could shake out long dollar positions i.e. those betting on a further squeeze.