There's a little bit of everything going on today but it seems that BOJ is holding court instead of the FOMC

The yen is gaining across the board and it's playing out in the majors too. Bloomberg note that a JPY trade weighted index is close to levels last seen when the BOJ eased last October. The Deutsche Bank index is up 0.64% to 103.93, close to the 104.24 we saw at the close 31st Oct 2014. JPYUSD accounts for 47% and JPYEUR 39% of the TWI

I think I've been focussing on the dollar a little too much today, what with the FOMC coming ahead of the BOJ. It seems the market has that firmly in its sights and the FOMC is just a side show

That might possibly be the case, and that's going to make the BOJ a very big event, even though most expectations, like those of the Fed, are for no change

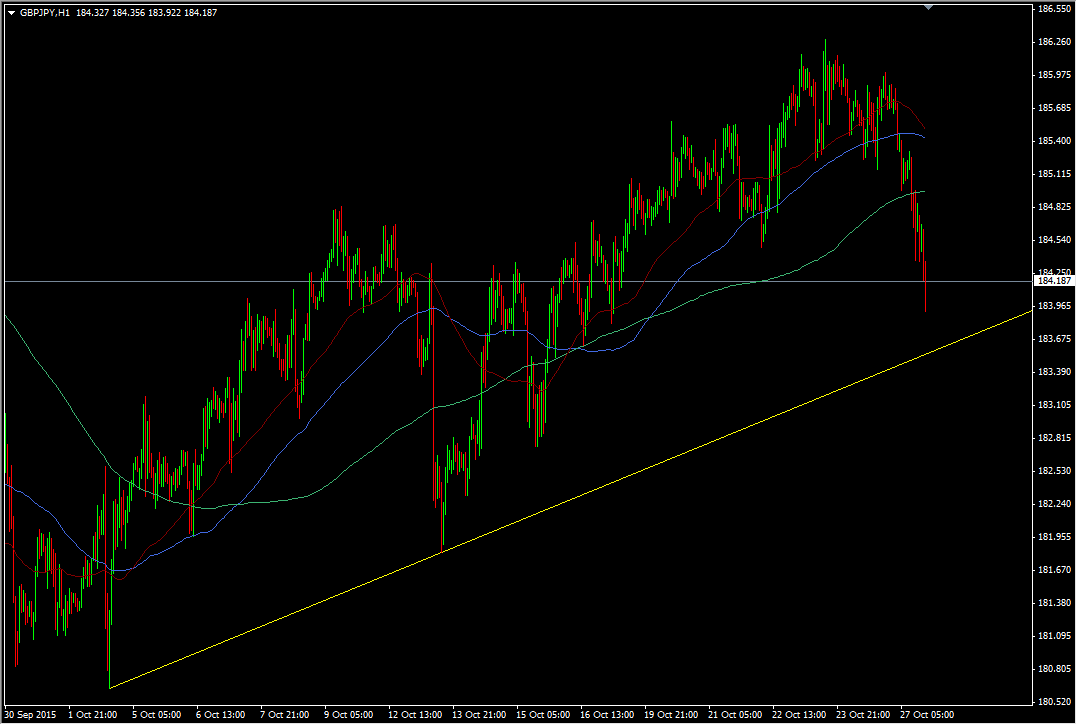

GBPJPY has been on a one way street today and has completed a 200 pip move from the late highs yesterday

GBPJPY H1 chart

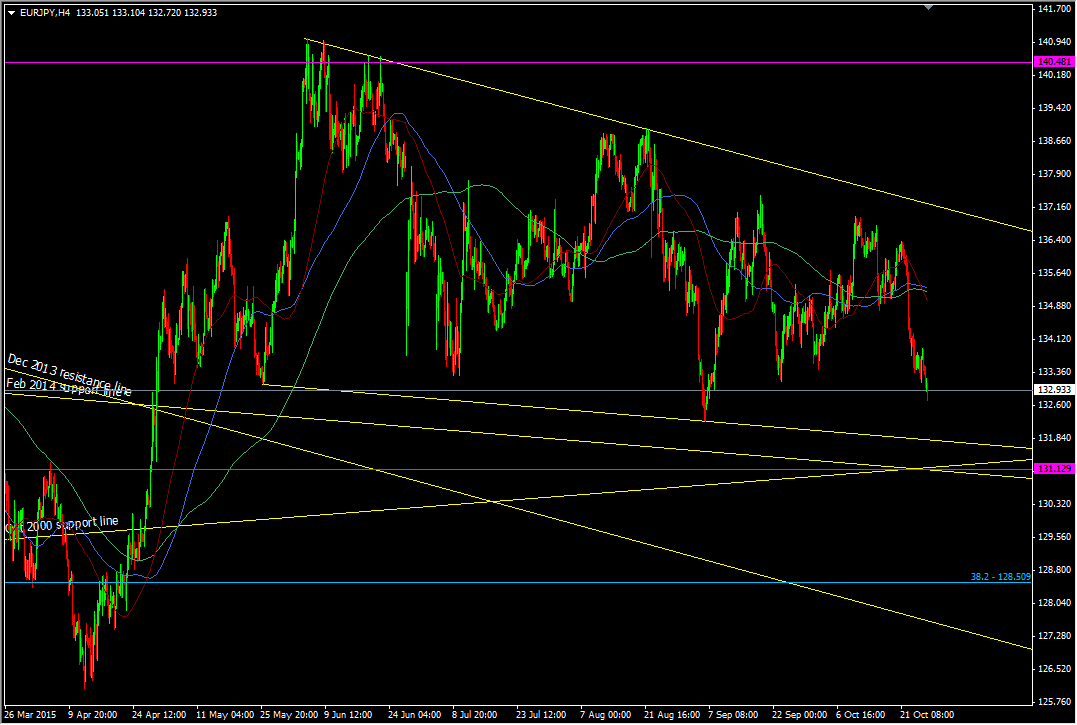

EURJPY has been a bit more sedate and is only down just over 100 pips in the same period

EURJPY H4 chart

What we're not seeing is the usual dollar strength/yen weakness ahead of the two meetings which highlights the markets is leaning towards unchanged. That puts the risk to prices on a move by either

What concerns me about the BOJ is how the market will react if they do increase QQE. If it's seen as a sign of panic then that may have the opposite effect in the yen than it would normally

I'm not confident of trading these two decisions right now so I'm leaning towards sitting on my hands for now