December 28, 2017

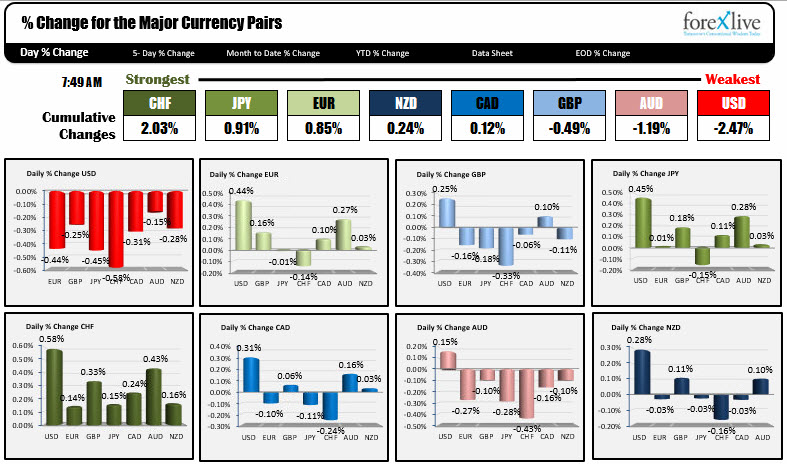

As the North American traders enter for the 2nd to last trading day of the year, the CHF is the strongest, while the USD is the weakest.

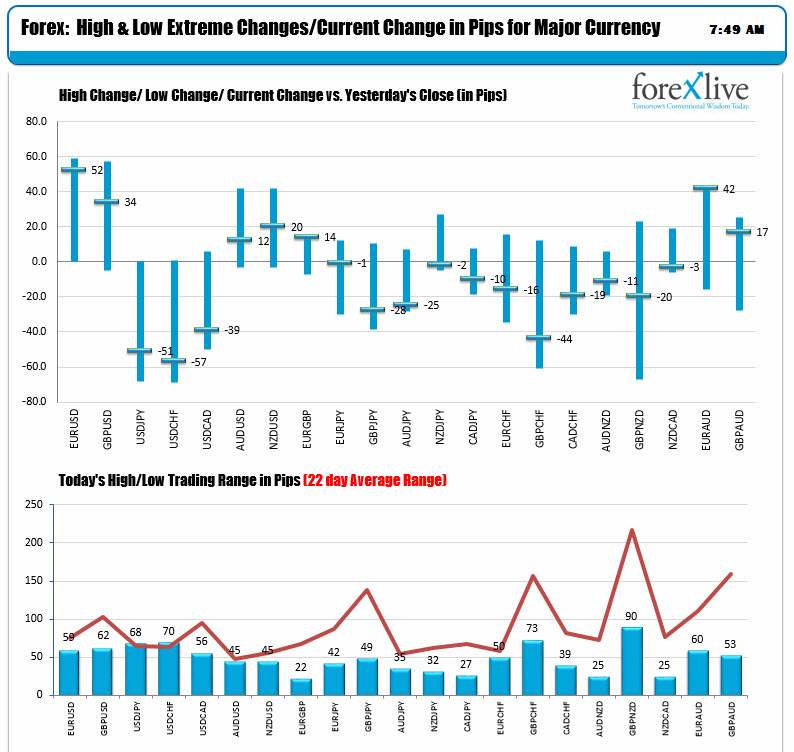

The ranges are pretty good for the end of year. Pairs like the USDJPY, USDCHF and AUDUSD has reached their 22 day average line (red line in the lower chart below). Twenty two days is about the number of days in a trading month. Those pairs trended from the start of the day with the dollar getting hit. The decline in the USD runs counter to the move in the debt yields. The yields of US debt are higher and that tends to be supportive to the dollar. The US stock futures in pre-market trading is also not running but not down either. The major indices futures contracts are up a bit.

In other markets:

- Spot gold is following the greenback. Gold tends to rise with the dollar fall. It is up $4.72 or 0.37% at $1292.

- WTI crude is unchanged at $59.61

- 2 year yield 1.903%, up 1 bp. 5 year 2.231%, up 3.77 bp. 10 year 2.4323%, up 2.2 bp. 30 year 2.7684%, up 2.2 bp

- US stock futures are up a bit. S&P futures are up 1.75 points. Dow futures are up 37 points. Nasdaq futures are up 15.75 points

- Bitcoin on Bitstamp are trading down -$910 at $14163. The digital currency is below the 100 hour MA at $14612.04

At 8:30 AM ET/1330 GMT:

- US initial jobless claims are expected at 240K versus 245K

- US wholesale inventories for November are expected to rise by 0.3% versus -0.5%. Retail inventories fell -0.1% last month

At 9:45 AM ET/1445 GMT:

- Chicago purchasing managers index for December is expected to come in at 62.0 versus 63.9 last month