September 29, 2017

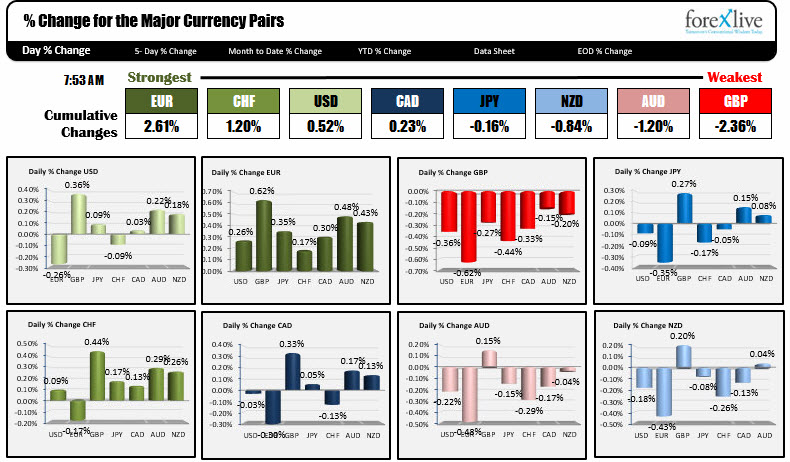

The EUR is the strongest and the GBP is the weakest (GDP YoY disappoints). That sounds like the EURGBP is on the run and indeed it is.

The EURGBP was on the slide earlier in the week as the EURUSD fell to key support at the 1.1710-20 area. The last few days has seen that trend reverse and today's move has really goosed the EURGBP higher. Looking at the chart below the pair inched above the 100 hour MA to the 200 hour MA (green line). After a corrective move, the pair pushed higher again. This time through the 200 hour MA. In the snapshot, the pair trades up 0.65%. It is the largest gainer on the day.

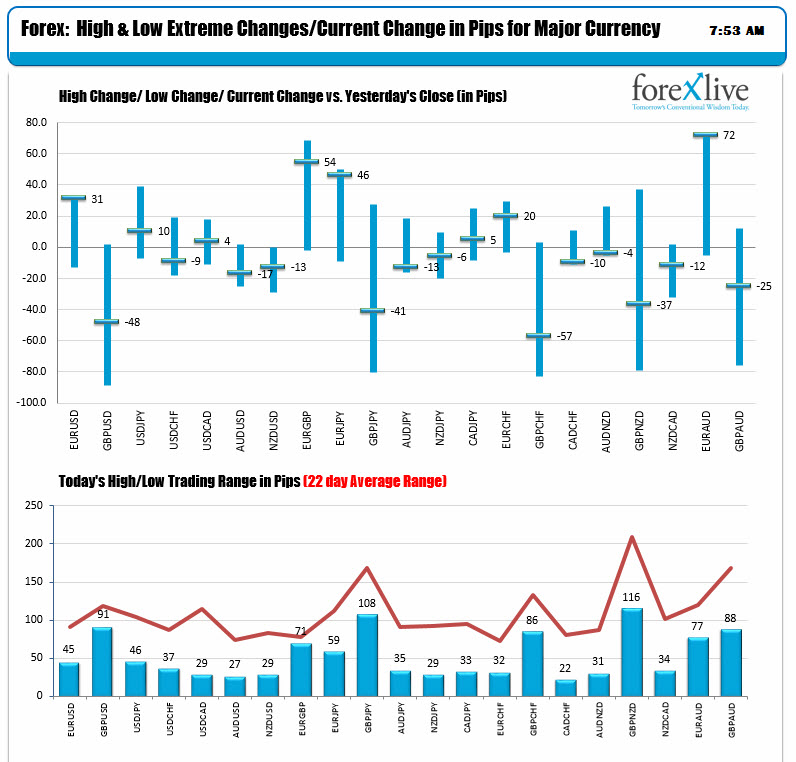

Looking at the changes and ranges, apart from the GBP pairs, the others are pretty pathetic. The EURUSD range is 45 pips. The average over the last 22 days (about a month of trading) is 88 pips. The USDJPY is 46 pips (avg 101 pips). THe USDCAD is only 29 pips. The average is 112 pips over the last month.

Canada has GDP, Industrial and Raw material prices and US has Personal income and spending, Chicago PMI and U. of Michigan to give the market a goose. Lots of room to roam.

In other markets today, the snapshot at the start of the day shows:

- Spot gold is down -$1.65 to 1285

- WTI crude oil is down -$0.11 to $51.46

- Yields in the US are up but by less than 1 bp out the curve

- US pre-open stock futures are mixed. S&P futures are down -1.25 points. Dow futures are down -9.00 points. Nasdaq futures are up 8.25 points. The S&P closed at a record yesterday.