January 4, 2018

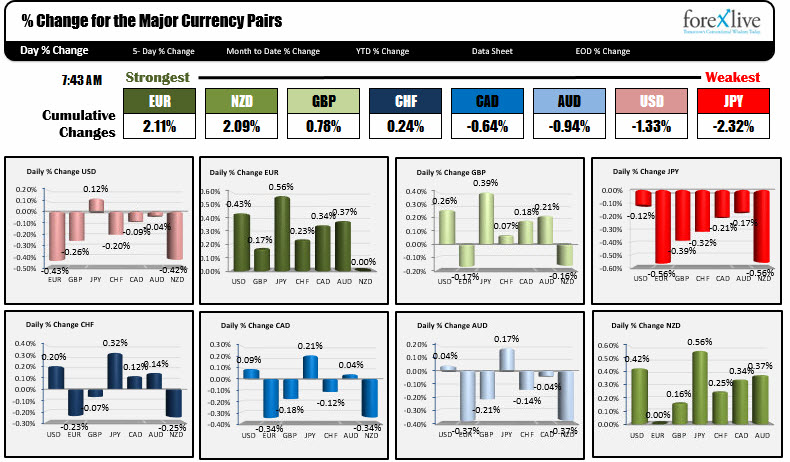

The EUR is leading the major currency league table as NA traders enter for the day, while the JPY are the weakest. In the US, the dollar is moving back to the downside after a one day up reprieve yesterday. It is only higher vs. the JPY.

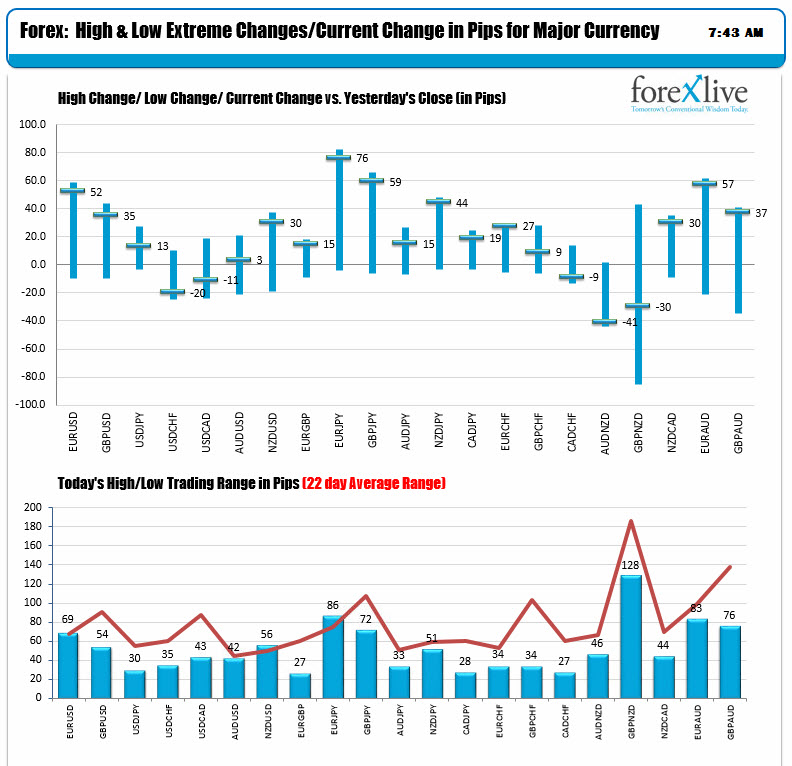

Looking at the volatility today, the EURUSD is outperforming and trading near the high for the day (up 52 pips). Yesterday, the pair moved down to natural support at the 1.2000 level and held. The other EUR pairs are also trading near day high levels today. The EURJPY is trending higher from the start. The EURGBP dipped before moving higher.

In other markets, the snapshot shows:

- Spot gold is trading down $.19 or -0.01% at $1312.89

- WTI crude oil is up $.15 or +0.24% at $61.78

- US yields are higher today: two-year 1.955%, up 2.4 basis points. Five-year 2.266%, up 2.1 basis points. 10 year 2.463%, up 1.6 basis points. Thirty-year 2.796%, up 1.1. Basis point

- US stocks premarket trading are higher: NASDAQ futures are up 17.25 points. S&P futures are up 4.5 points. Dow futures are up 85 points

- European stocks are running higher with the German DAX up 1.12% French CAC up 1.33%. Spain's Ibex up 1.63%. Italy's FTSE MIB up 2.17%. The UK FTSE is lagging. It is only up 0.15%

The ADP employment change will be released shortly with expectations of 190K vs 190K last month. The US nonfarm payroll report will be released tomorrow at 8:30 AM ET/1330 GMT.

US initial jobless claims will be released at the bottom of the hour with an estimate of 241K versus 245K.

At 9:45 AM/1445 GMT the Markit services PMI final for December will be released with the expectations of 52.5 versus 52.4 in the preliminary report. The composite index will also be released. There is no estimate. The preliminary reading came in at 53.0.

Crude oil inventory data will be released from the Department of Energy at 1600 GMT. Crude oil inventories are expected to show a drawdown of -4700K.