The USD is marginally higher. It's Friday.

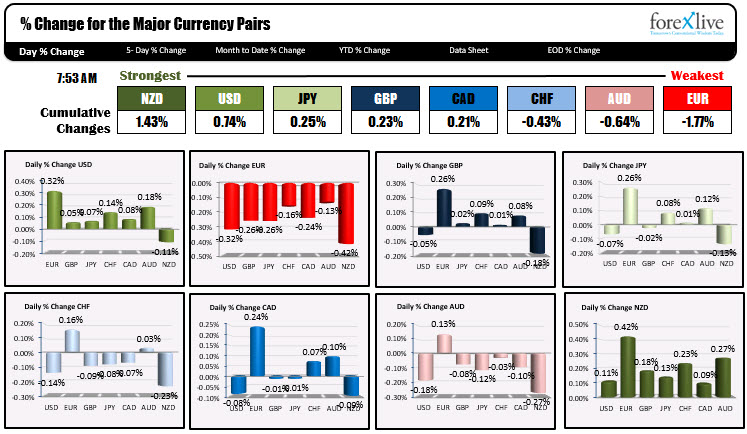

It's Friday! That can mean a lot of things but with all the uncertainty from Covid, to elections, to will there be a transition from elections, to new stimulus or no new stimulus, to Brexit, etc. the volatility meter could be all over the place. The morning snapshot shows NZD is the strongest and the EUR is the weakest. The changes are relatively modest across the major currency spectrum. The USD is marginally higher vs all majors with the exception of the NZD. US durable goods orders will be released at the bottom of the hour.

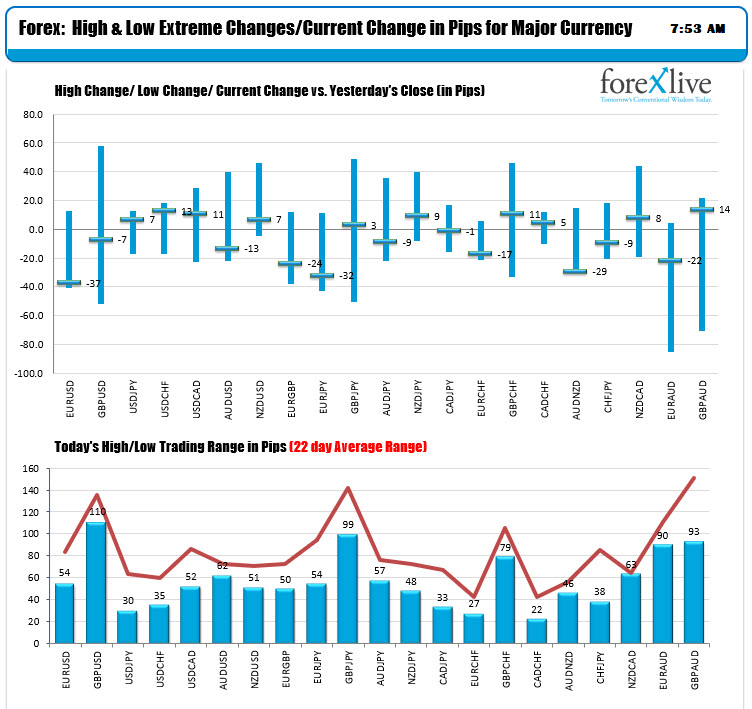

The snapshot of the ranges and changes shows volatility in the GBPUSD and the GBP pairs. The GBPUSD moved up near 60 points and then moved down on the day by about 50 points before bouncing back toward unchanged. The GBPJPY did a similar run (up 3 pips now). The EURGBP however, remains more pressured. Other pairs vs the USD are within 13 pips of unchanged. The NZDUSD is higher but it gave up most of the earlier gain in the morning snapshot.

In other markets:

- Spot gold is back down on the day as the greenback moves marginally higher. The price is down $6.40 or -0.34% to $1861.55

- Spot silver is down $0.31 or 1.37% at $22.82

- WTI crude oil futures trading lower by $0.31 or -0.76% to $40

In the premarket for US stocks, the futures markets are implying a mixed opening:

- The Dow Jones down minus 92 points

- S&P index is down -8.8 points

- NASDAQ index is trading up + him 18 points

In the European equity markets, the major indices are lower.

- German DAX, -1.5%

- France's CAC, -1.4%

- UK's FTSE 100, -0.3%

- Spain's Ibex, -0.8%

- Italy's FTSE MIB, -1.1%

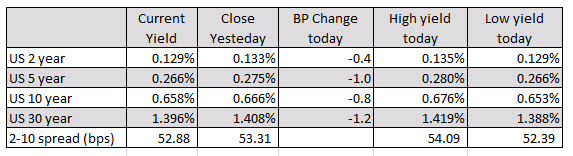

In the US debt market, the snapshot of yields are modestly lower with the yield curve also a little flatter:

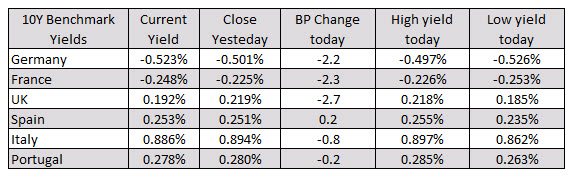

In the European debt markets, the benchmark 10 year yields are mostly lower with the exception of the Spain 10 year which is up a modest 0.2 basis points.