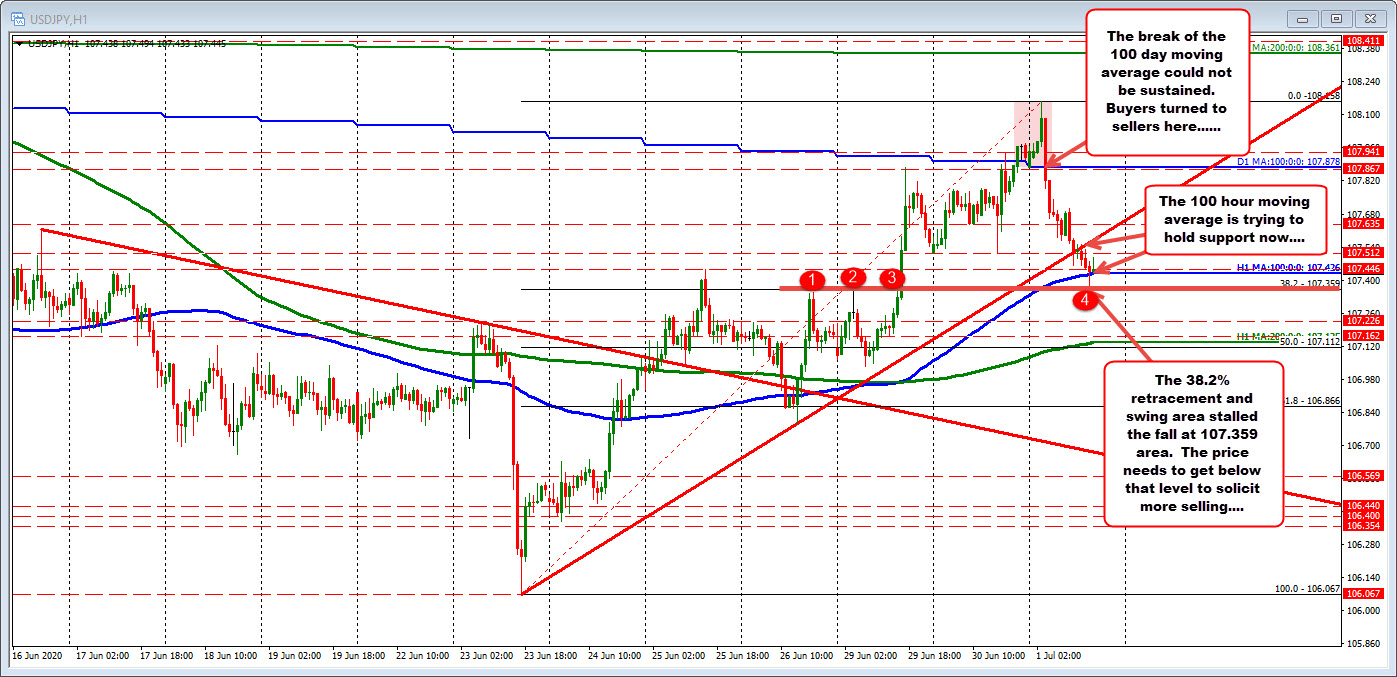

Price doesn't fall below upward sloping trendline and 100 hour moving average in the process

The USDJPY is trading lower on the day after a move above its 100 day moving average late yesterday and that the start of the new trading day faded.

The 100 day moving average comes in at 107.878 today. The price moved above it in the last few hours of trading yesterday and extended to the highest level since June 9 at 108.158 before reversing lower. Buyers turned to sellers after breaking back below its 100 day moving average and trundled lower.

The fall took the price below an upward sloping trendline (currently at 107.56). And its 100 hour moving average at 107.426 currently (blue line in the chart above). However, the next target at the 38.2% retracement at 107.359, and recent swing highs from June 26 (at 107.346) and June 29 (at 107.367), stalled the fall. The low reached 107.355.

The price currently trades at 107.47 in this trying to hold support against its 100 hour moving average and the currently hourly bar.

If the price can hold that 100 hour moving average level, we could see a rotation back to the upside. If not getting below the 38.2% retracement is still a hurdle that needs to be surpassed. A correction to the 38.2% retracement is simply a plain-vanilla correction.

Overall some bearishness, but the bearishness has found a stall point at a corrective target. Getting below the 100 hour moving average and 38.2% retracement is still key for further downward momentum.