The euro is struggling to find a bid after it's bashing

This is what happened to the euro yesterday

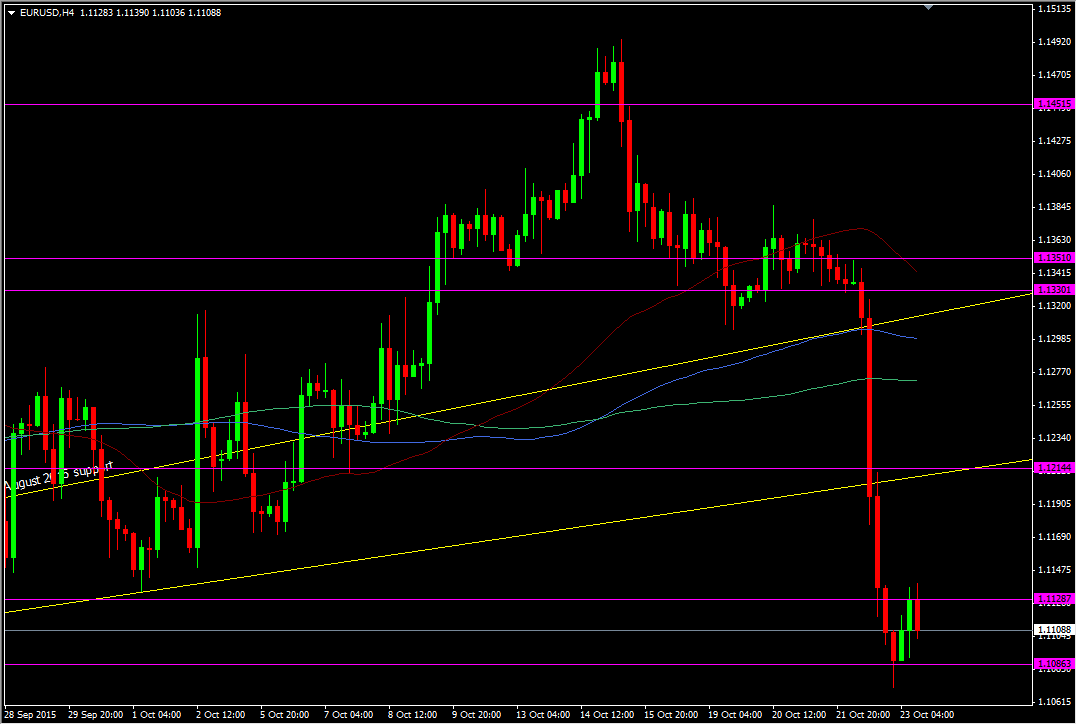

As Adam highlighted last night, the lack of bounce in the euro following the fall is very telling and is often a warning sign

There becomes a distinct lack of buyers except when the down moves reaches an exhaustion point. At the moment that point is around 1.1070, though that was stepped up to 1.1080/85 and now 1.1100

EURUSD 15m chart

That presents some willingness to mark a line in the sand. The market has reacted and is now finding some balance. 1.1140 is the first main line of resistance. That in itself isn't anything major so if buyers want to push then it's going to be like feeling their way in the dark until they find the real sellers, and you can bet they're out there

Around 1.1190/1.1215 is where I'm expecting them to be strongest. We've already had confirmation of the break as the price came through yesterday so we know there is interest there

EURUSD H4 chart

Above 1.1215 we may find resistance coming in around 1.1260/70 and then stronger at 1.1300. That looks a million miles away given the price action right now. If 1.1070 goes then the next decent support isn't until 1.1015/20

We have the US Markit manufacturing PMI flash later but not much else. Being Friday there is obviously the risk that we see some brisk profit taking into the weekend on the back of this sharp fall. If we do see a move higher be mindful that this is what it is and not euro longs suddenly becoming trader's choice

So watch the 1.1070 and the 1.1200/15 levels for the range that needs breaking to bring about the next direction