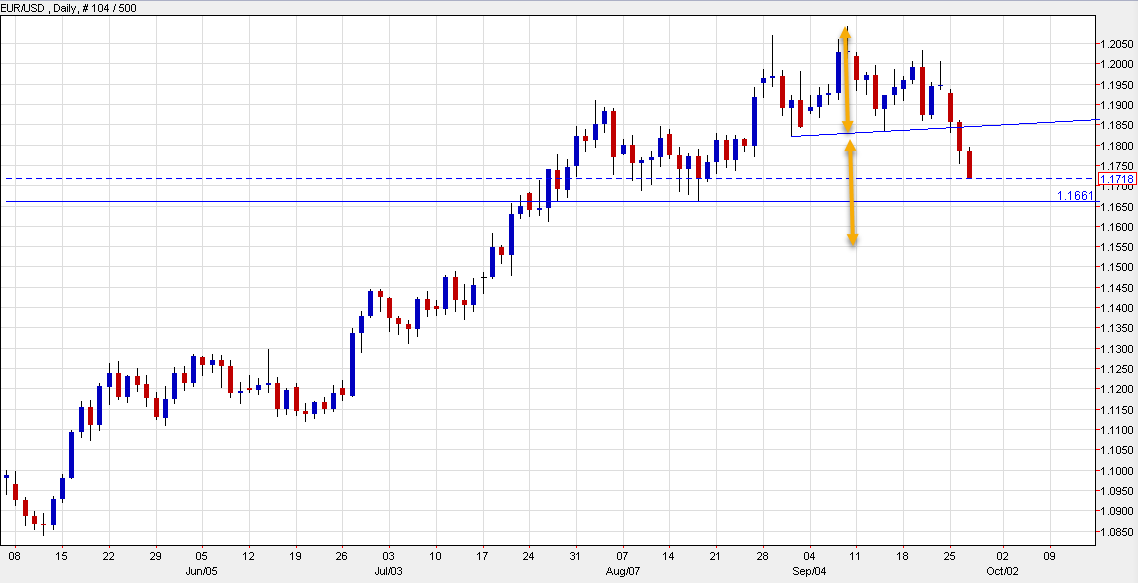

EUR/USD continues to resolve head & shoulders pattern

I wrote yesterday about how the EUR/USD chart was ugly and it continued to get uglier today, falling another half-cent. It hit a session low of 1.1718 in the past few minutes.

Technically, the chart is a dream. You have three shooting stars at the Aug/Sept highs and a head-and-shoulders top. It's been straight downhill since the neckline broke.

All the talk is about the August low of 1.1661 right now and that's an entirely reasonable target. But there might be more. The measured target of the head-and-shoulders is 1.1550 and with the long side of the trade so crowded and tax reform on the agenda, it could get ugly. The 38.2% retracement of the rally since April is just below 1.1500, while there is another cluster of support in the 1.14 zone.

So what's the trade now? I think those who didn't get into shorts earlier in the week would be prudent to sit this one out, or at least wait for some kind of catalyst to sell (perhaps US PCE on Friday).

Finally, note that Greg highlighted the 1.1711 zone near the 200-week moving average in his great video this week.