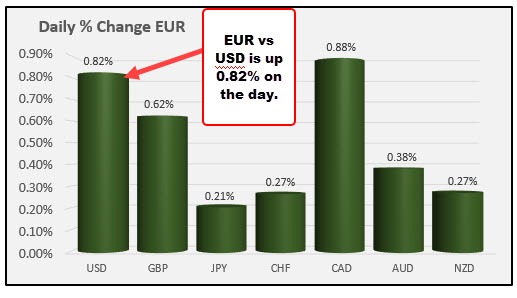

The EUR is the strongest of the majors as traders react to a shift in the bias back to the upside technically. The price was banging against the 200 hour MA coming into the day (from the bottom) and the MA was stalling the rise.

Then toward the end of the London day, the price broke above that MA and the higher 100 hour MA. The sellers turned to buyers and the price moved higher.

As I have talked about ad nauseam, the pair still remains in the 14 day trading range with the 50% at 1.02829, and the failed break from Tuesday up at 1.02933 as the ceiling to break through and the low from July 27 at 1.0960 as the floor. The 100/200 hour MAs (blue and green lines) are the mid-range barometers for buyers and sellers.

Ahead of the ceiling sits a swing area at 1.0254-57. Get above that, and traders should be ready to make a run toward the 50%/high from Tuesday (right? They have to be ready?) again. Get above, and look for more momentum.

That is the bullish play for buyers. For doubters that the EURUSD can sustain upside momentum with economic headwinds including prospects for natural gas shortages, risk from Russia, the end of summer travelers, etc. The pair is approaching the sell zone (with stops on a break above).