The major US indices are lower to start the US trading day.

The S&P index is lower for the 1st time in 4 days. Yesterday, the index tested its 200 day moving average currently at 4324.51. Sellers leaned against the level and closed below the key level. The move lower today away from that moving average, may give sellers a reason to further correct the index from a technical perspective

The Dow industrial average is back down retesting its 200 day moving average at 33879.91. In early trading, the moving average was tested and so far held support. A move below today would tilt the bias back to the downside at least in short-term for the Dow 30.

A snapshot of the major indices 8 minutes into the opening is showing:

- Dow industrial average -201 points or -0.59% at 33952.

- S&P index -30.11 points or -0.70% at 4274.78

- NASDAQ index -123 points or -0.94% at 12978.65

- Russell 2000-25.08 points or -1.24% at 1995.45

In the US debt market, yields are higher after the mixed but mostly better retail sales report:

- 2 year yield 3.354%, +8.6 basis points

- 5 year 3.046% +9.0 basis points

- 10 year 2.886%, +8.0 basis points

- 30 year 3.143%, +5.1 basis point

In other markets,

- Crude oil is trading at $86.47 that is near unchanged levels on the day. The low price reached $85.90. Yesterday the low price traded to the lowest level since January 26. The low price reached $85.74, just below the low price for today at $85.90

- spot gold is trading down $-8.05 at $1768.05

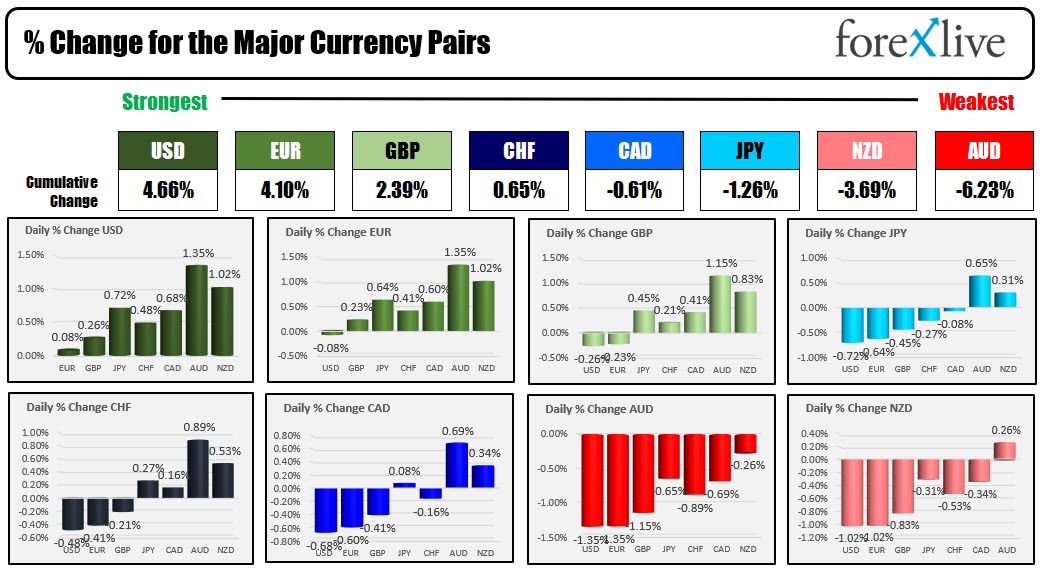

A snapshot of the forex market is showing the USD remains the strongest of the majors. THe AUD remains the weakest.

.