The Fed will kick off the rate hike cycle today with a rise of 0.25 basis points most likely. That is the amount that the Fed chair Powell indicated at his testimony a few weeks ago. The rise in gas prices and concerns about the impact from the Russia/Ukraine war is likely to keep that rise at that level. However, the market will be looking for signs that a 50 basis point acceleration might be in order sooner rather than later if inflation continues to be elevated and expectations rise as a result. The Fed will also release its central tendencies (GDP likely lower for 2022, inflation likely higher, employment probably around the same), and projections from its dot plot. In December, the Fed targeted three hikes in 2022. The market expects more like seven. The Fed will likely be in the 4 to 5 hike range.

Ukraine president Zelensky will speak remotely to the U.S. Congress today. There have been overtures from both sides that a agreement might be closer, but Russian Pres. Putin also said that Ukraine was not serious in wanting a cease-fire. Russian government debt payments are expected to go into default, as it has signaled it wants to make interest payments in rubles versus the US dollars due to the sanctions.

In China, the government and central bank said that they would support the economy and particularly the financial markets. The Chinese stocks had their biggest one-day gain in years. The Hong Kong's Hang Seng index rose 9.08% on the day. That was the best day since October 2018. Even still, the index is down 2% on the week after having heavy losses. The Shanghai composite index rose 3.48% and the Shenzhen index rose by 4.01%.

There is a heavy economic calendar ahead of the FOMC decision with Canada CPI data, US retail sales, and import/export prices all released at 8:30 AM ET. At 10 AM, business inventories and NAHB housing pricing data will be released.

US stocks are higher in premarket trading as are European shares. Crude oil is up modestly. Gold is also up modestly US yields are little changed as well.

A snapshot of the markets currently shows:

- Spot gold trading up three dollars or 0.15% at $1922

- Spot silver is up one cent or 0.05% at $24.89

- WTI crude oil futures are trading at $96.84 up $0.38

- Bitcoin is trading back above the $40,000 level at $40,556. It traded as high as $41,693.97 and as low as $38,865.67 in overnight trading.

In the premarket for US stocks:

- Dow industrial average is trading at 394 points after yesterday's 599.10 point rise

- S&P index 56 points after yesterday's 89.32 point rise

- NASDAQ index is trading up 246 points after yesterday's 367.4 point rise

In the European equity markets, the major indices are also solidly higher:

- German DAX is up 3.37%

- France's CAC is up 3.75%

- UK's FTSE 100 is up 1.37%

- Spain's Ibex is up 2.3%

- Italy's FTSE MIB is up 3.35%

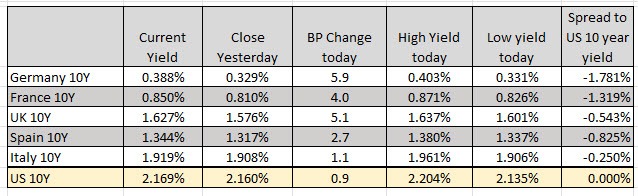

In the US debt market, yields are little changed ahead of the rate hike:

In the European debt market, the benchmark 10 year yields are trading higher with the German tenure up to 0.388%: