As the North American traders enter for the day, the CHF is the strongest and the AUD is the weakest. The USD is mostly lower for the 2nd consecutive day. The EUR is higher and back above the parity level ahead of the ECB rate decision at 8:15 AM ET. The ECBs Lagarde will start her press conference at 8:45 AM ET. It is a toss up on 50-75 basis points. THe USDJPY is lower. The USDJPY moved to another new high going back to 1998 yesterday, but did back off over 50% of that move by the close. Today, the pair is lower on the day. The price has been up 8 of the last 9 trading days. The one down day was a 2 pip decline (so virtually unchanged). There was some jawboning after officials gathered to discuss the weakening currency, saying:

- Agreed at meeting on need to watch markets with strong sense of urgency

- Recently seeing speculative, one-sided rapid yen moves

- Recent yen decline cannot be justified based on fundamentals

- The moves are clearly described as excessive volatility

- Will not rule out any steps, ready to take action in FX market

- All options are on the table

UKs Truss announced the end to end fracking ban and will cap domestic energy prices at 2500 pounds. The Queen meanwhile is ill with doctor concerns. The queen is 96 years old and has said on the throne for 70 years.

Fed's Powell is to speak at the Cato Institute at 9:10 AM ET. The US initial claims are due at 8:30 with estimate at 234K. US stocks are mixed.

In other markets:

- spot gold is trading up $8.72 or 0.51% at $1726.50.

- Spot silver is up $0.27 or 1.5% at $18.72

- crude oil is trading up near $0.80 at $82.79

- bitcoin is back above 19,000 at $19,314. The low price yesterday reached $18,540

In the premarket for US stocks, the major indices are little changed after yesterdays a sharp rises:

- Dow industrial average is up 43 points after yesterdays 435.98 point rise

- S&P index is up 2.93 points after yesterdays 71.68 point rise

- NASDAQ index is unchanged after yesterdays 246.99 point rise

In the European equity markets the major indices are mixed ahead of the interest rate decision:

- German DAX -0.6%

- France's CAC +0.1%

- UK's FTSE 100 +0.05%

- Spain's Ibex -0.45%

- Italy's FTSE MIB -0.5%

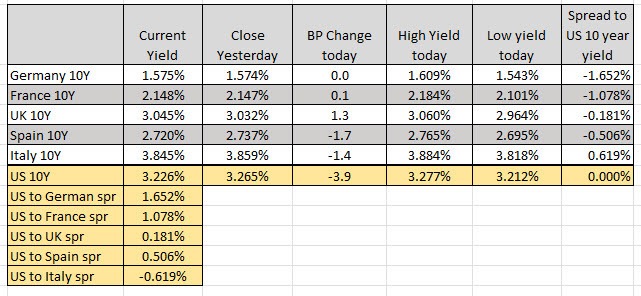

In the US debt market, yields are lower for the 2nd consecutive day.

In the EU debt market the benchmark 10 year yields are mixed: