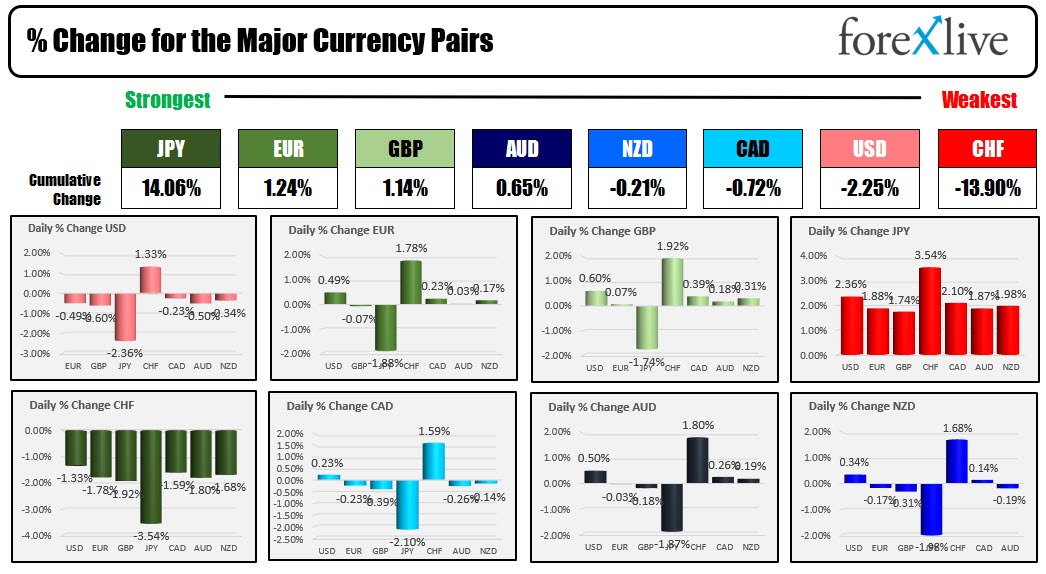

The JPY is the strongest and the CHF is the weakest as the NA session begins. The central banks were in focus again today after the Fed hiked rates by 75 BPs yesterday and projected a faster rise in the months ahead (into year end). The SNB raised rates by 75 basis points (the market was sorta tilting the 100 bps). The action send the EURCHF and the USDCHF higher (weaker CHF). The SNB warned of potential intervention.

The BOE hiked by 50 basis points with a couple members dissenting in favor of a 75 basis point hike. The GBPUSD moved up toward its 100 hour MA at 1.13698 (the high reached 1.13633).

Norway, Indonesia and the Phillippines also hiked rates to keep up (sort of) with the US.

The BOJ did not join the hikefest as expected but they did intervene (first since 1998) in the currency market to slow the JPYs decline. A new cycle high (and new high in the USDJPY going back to 1998) was reached at 145.89. The intervention sent the USDJPY price sharply lower reaching a low of 140.63 and below the September 9 low at 141.49. The 50% of the move up from the August 23 low comes in at140.845. The price is trading at 141.16 as the NA session gets going.

In other markets:

- spot gold is trading near unchanged at $1673.67

- spot silver is trading up $0.09 or 0.41% at $19.62

- WTI crude oil is trading at $84.54 up 1.92%

- The price bitcoin is back above the $19,000 level $19259 after trading as low as $18,368 today

In the premarket for US stocks, the major indices are mixed after yesterdays declines.

- Dow industrial average is up 104 points after yesterdays -522.45 point decline

- S&P index is up 8 points after yesterdays -66 point decline

- NASDAQ index is up 15 points after yesterdays -204.86 point decline

In the European equity markets:

- German DAX, -0.56%

- France's CAC -0.68%

- UK's FTSE 100 -0.17%

- Spain's Ibex -0.31%

- Italy's FTSE MIB -0.16%

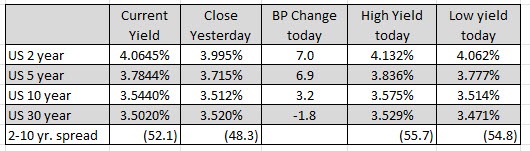

In the US debt market, yields are mixed as the yield curve inverts more. The 2 – 10 year spread is down to -52.1 basis point (closed at 48.3 basis points)

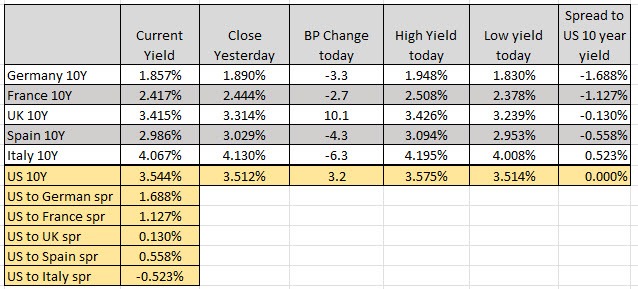

In the European debt market, the benchmark 10 year yields are mostly lower with the UK yields up 10 point basis points