Short covering is getting most of the blame for the moves

I noted one of our astute readers noting talk of short covering earlier on and more of that chatter is doing the rounds. There has also been some additional option plays noted as $1bn in EUR calls in overnight strikes at 1.0600 were purchased yesterday. There's 2.1bn going off at 1.06 on today's expiry and 4.1bn tomorrow. There's also some large strikes covering 1.0500 and 1.0800 in place over the few days

Model accounts have also been buying euro's today, among others. The offers at 1.0650 that Mike noted are said to have stops behind them

Going on the price action it looks like we're seeing the shorter term players squaring and covering rather than the long term shorts. Be prepared to see these moves increase as we head further toward the ECB. I'll give the usual warning that these moves are not ones you chase thinking that the trend is over

Take them for what they are and use the levels in place to lean against. Considering we've hardly come up off the floor since we hit the low 1.05's that's the biggest clue to the real strength of these moves

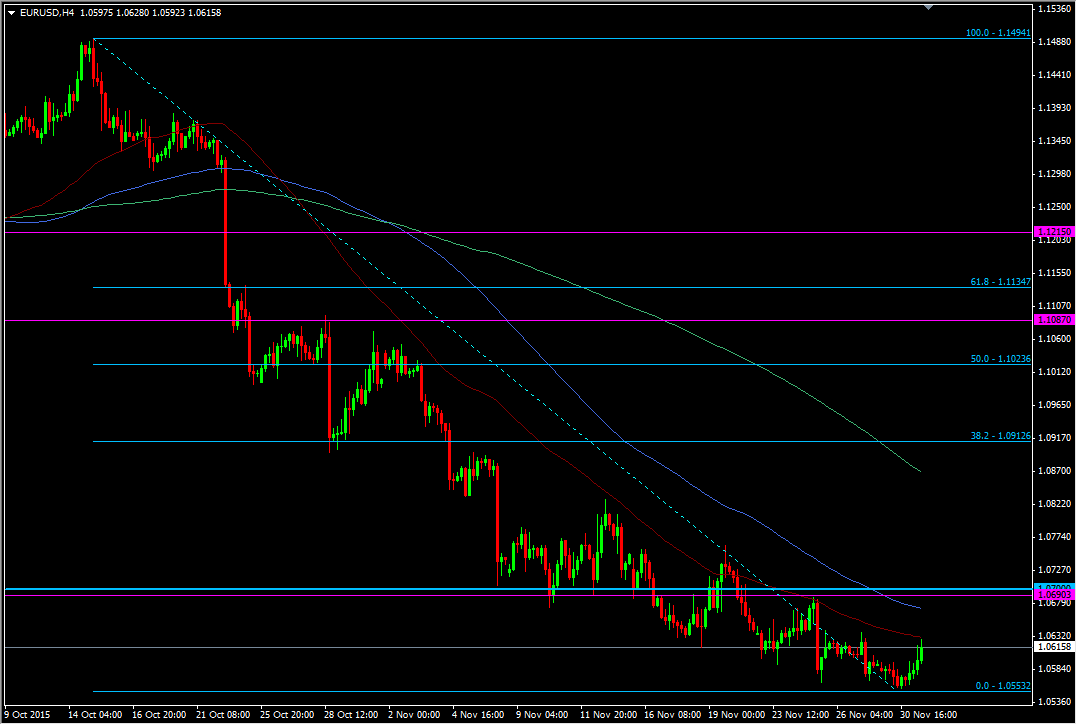

EURUSD H4 chart