Earlier previews of the US inflation data due today are here:

- JP Morgan are forecasting lower than expected US CPI data on Thursday, & stocks higher

- Preview: All eyes on Thursday's UP CPI report with Goldman Sachs and CIBC seeing a miss

The below is via National Australia Bank, making the point that the data will be eyed as a clue to the next move from the US Federal Open Market Committee (FOMC):

- US CPI tonight t was always going to be the week’s banner event and nothing so far this week has diminished the significance of it, especially with several Fed officials in recent days openly talking of the February 1 FOMC decision being between either 25bps or 50bps. Which side of expectations CPI falls could well be crucial to this debate. Consensus is for headline CPI to fall to 6.5% from 7.1%, and for the core (ex-food and energy) measure to 5.7% from 6.0%. Data in line with or lower this this would likely see markets lift their current comfort level with 25bps rather than 50bps.

The latest Fed official to flag a favoured 25bp rate hike is head of the Boston Fed branch Collins:

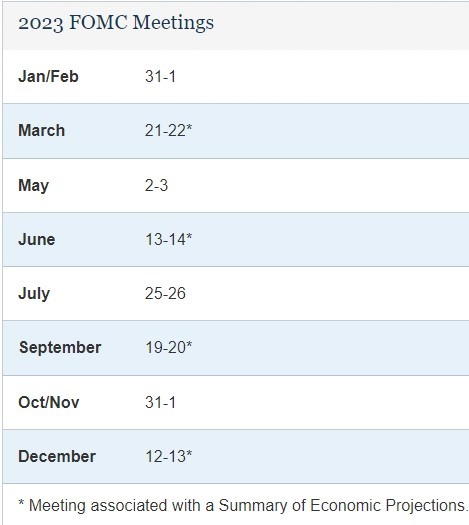

The next FOMC meeting is January 31/February 1: