A piece from ANZ on the mass Monetary Authority of Singapore and the SGD.

In brief:

- We changed our view on the Monetary Authority of Singapore (MAS) after … poor advance Q2 GDP release, calling for a policy easing at the October review. Our conviction of a MAS easing has strengthened after … dismal Non-oil Domestic Exports (NODX) data.

- Though we are still some way off the October meeting, and the US Federal Reserve looks set to cut the fed funds rate at the end of this month, we now recommend positioning for a weaker Singdollar. We cannot rule out the possibility of an intra-meeting move by MAS.

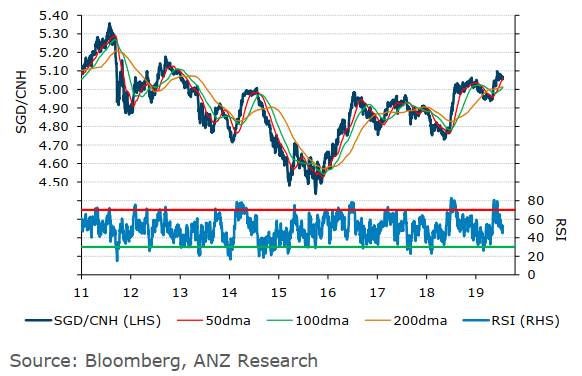

- As such, we are closing out our short AUD/SGD position for a 0.6% gain. We are initiating a short 3-month SGD/CNH forward position at 5.078 (spot reference 5.068) targeting 4.950 with stop-loss at 5.140.

On the SGD:

We are shorting SGD against the offshore yuan for three reasons

- Chinese authorities have made it clear that they have no intention of allowing the yuan to weaken too far

- even if the yuan were to weaken materially, given its relatively high weighting in the S$NEER basket, this would also result in a decline in SGD with more potential downside

- SGD/CNH cross looks to have topped out at around 5.10 and is currently just above near-term technical support at its 50dma. A break below that support level could open up a move towards 5.00 in the first instance