Via Bloomberg

For anyone following the central bank divergence between the RBA and the RBNZ I came across this interesting article from the the Bloomberg's market live blog written by Masaki Kondo on the potential of a more bullish turning point for AUD.

The guts of the piece is as follows:

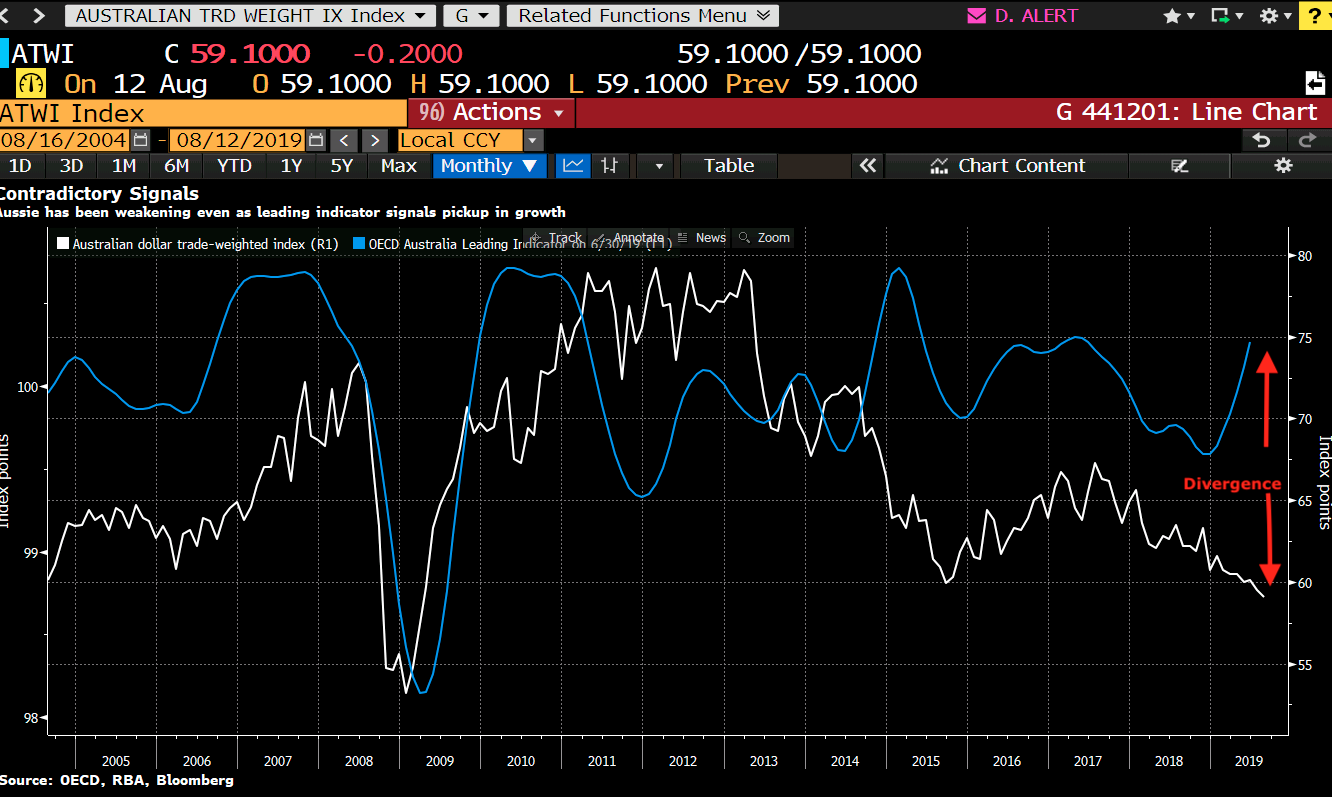

Australia's OECD leading indicator has been rising since December even though the trade-weighted index for the country's currency has been falling, pushed down by the RBA's easing policy. Leveraged funds are net short the Aussie too/There is a risk that the record low borrowing costs starts to have a more visible effect on the economy. Here is a look at the chart below:

There is certainly a lot of fear in the markets at the moment and if the sky does not fall down then some rebalancing will need to be done. Two nights ago night RBA assistant Governor Kent said that the lower rates are easing financial conditions in the the usual way and that recent broad based easing will support demand, while he also noted the RBA is not targeting unemployment rate with policy and it is unlikely that negative rates are needed in Australia but added that some unconventional policies are needed. Australian business confidence also moved up to +4 index points showing a broad based lift amongst industries. Last night showed a beat on Q2 Australia wage price index at 0.6% q/q vs 0.5% expected. This adds some more weight to AUDNZD longs as the RBA is less dovish than the RBNZ who cut interest rates by a surprise 50 bps last week.