AUD traders, a heads up for some Australia data - labour market employment report due at 0130GMT on Thursday 13 September 2018

The two market moving headlines are:

- Employment Change: expected +18.0K, prior -3.9K

- Unemployment Rate: expected 5.3%, prior 5.3%

Also watch for:

- Full Time Employment Change: prior was +19.3K

- Part Time Employment Change: prior was -23.2K

- Participation Rate: 65.6% expected, prior was 65.5%

Previews posted already:

- ANZ: Australian monthly jobs report (for August) today - preview

- Westpac: we have forecast an around trend 18k for August.

- TD (looking for an outlier result indeed, check it out): Australian monthly jobs report is due Thursday 12 September 2018 - preview

And, if you are down this far, a couple more (bolding mine):

RBC:

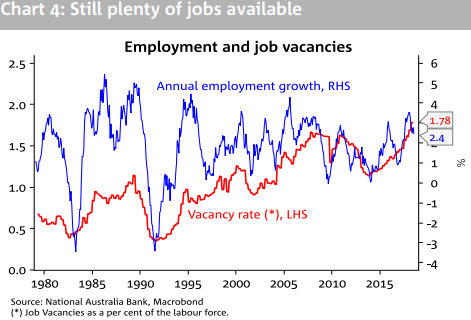

- Monthly employment outcomes have been volatile of late although the underlying trend has firmed, consistent with an economy travelling at an above-trend pace.

- We look for an increase this month not far from trend of +22k. A small rise in the numbers of unemployed persons after several months of declines, and a lift in participation should see the unemployment rate edge back up to 5.4%. We expect the quarterly underutilisation rate to move lower by around a quarter of a percent to 8 ¼%, but this remains elevated by historical standards and consistent with ongoing labour market slack

NAB:

- Even though it's based on a modest-sized sample, the monthly ABS Labour Force report is still possibly the most closely followed and market-sensitive indicator.

- After plugging the unexpected decline of 3.9K in employment in July into our models that take in a raft of labour demand and supply indicators, our forecast calls for a modest rebound of 15K in August. We consider there to be upside risk to this print as ABS data has been lagging behind NAB's Employment Proxy, though the latter has also slowed in recent months.

- A 15K print should be sufficient to keep the unemployment rate at 5.3%, the lowest since November 2012. Market forecasts call for a similar 15-18K rise in employment.