Canadian third quarter GDP highlights:

- Q3 GDP +2.3% vs +2.3% expected

- Q2 growth was -0.54% (revised to -0.30%)

- Q1 growth was -0.78% (unrevised)

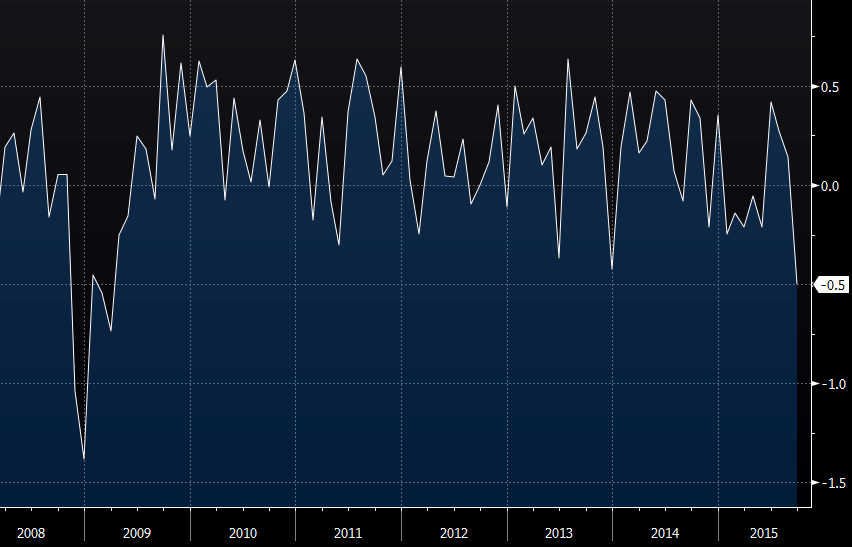

- September GDP -0.5% m/m vs +0.0% exp

- August GDP previously reported at +0.1% m/m

- GDP y/y 0.0% vs +0.4% exp

- Prior y/y GDP growth was +0.9%

- Full report from StatsCan

Canada emerges from a minor recession.

The mix of revisions skews lower. Note the softness in year-over-year GDP. The September reading was also the softest since 2009 and that's the most up-to-date reading. USD/CAD jumped higher on the headlines.

More details:

- Exports rose at 9.4% annualized pace

- Oil and gas led the Sept contraction of 5.5% m/m "mainly as a result of a large decrease in non-conventional oil extraction"

- Support activities for oil and gas extraction fell 13% in Sept

- Manufacturing output decreased 0.6% in September

- Wholesale trade contracted 0.3% in September (down 1.1% in the quarter)

- Retail trade expanded 0.3% in September (up 0.8% in the quarter)

- Construction was unchanged in September

This doesn't look good for Q4 growth. The rebound in Q3 was led by oil and gas but that rebound evaporated at the end of the quarter and oil prices remain in the doldrums. Trade hasn't picked up any of the slack.

Retail, finance and real estate are the only parts of the economy that are firing. that's not a recipe for a sustained recovery.