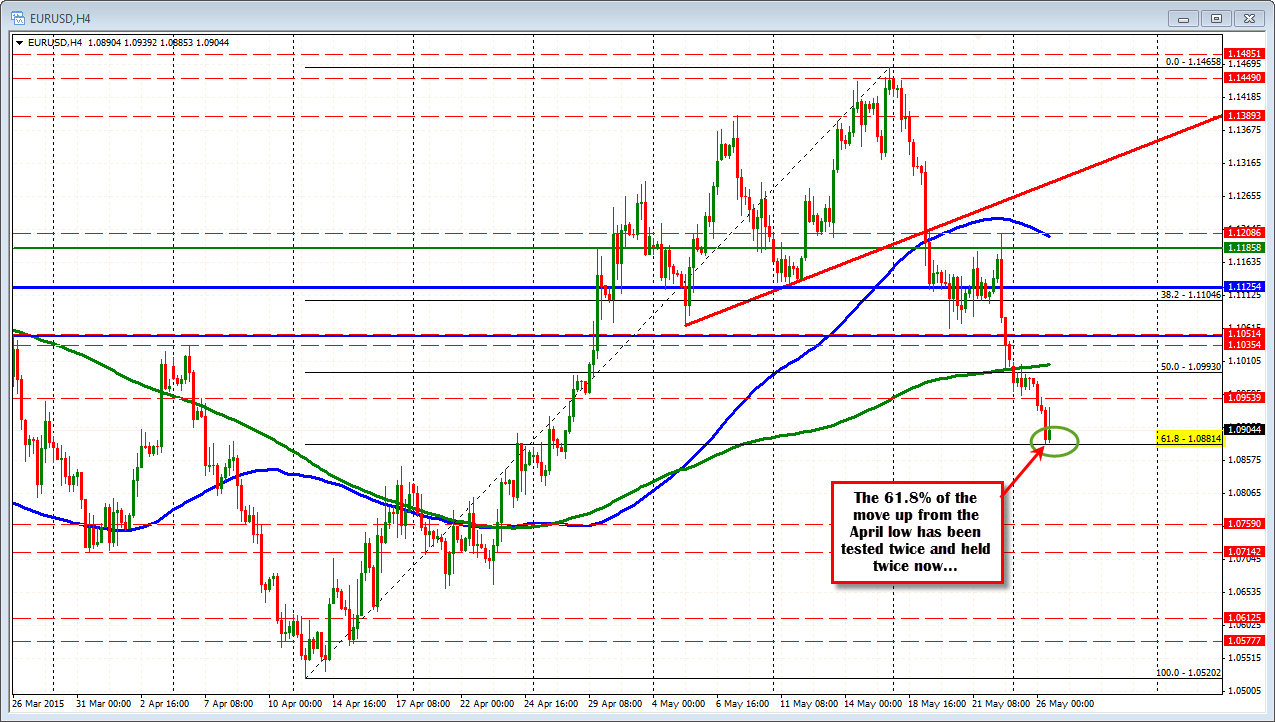

Pair finds support at 61.8% retracement of move up from April low

The EURUSD continued the fall in trading today, but did find support against the 61.8% of the move up from the April 13 low (see 4 hour chart) - now three times. The 61.8% level comes in at 1.0881 and the low came in for the day at 1.0884

The first two tests and bounces occurred during the London morning session. The 3rd test came after the stronger-than-expected durable goods orders in the US. There seems to be support buyers leaning against the retracement level. That level will need to be broken if the price is to continue lower (needless to say).

On the topside, the pair held the 200 bar MA on the 5 minute chart on the rebound off the London morning lows. This rebound did take the price above the days midpoint by a few pips but it was only briefly. This area will become a level to eye above. .

The better data and better tone for the US dollar should keep the sellers in charge, but with support holding three times, there may some apprehension by the market. More US data to come. The battle lines have been drawn.

PS. the range for the day is 102 pips. The average over the last 22 trading days has been 141 pips. So there is room to roam on a break. But needs that break.