Quarter end could keep the market on edge in trading today

The EURUSD has moved to the upside in the last few minutes of trading, and in the process is back up testing the the days midpoint at the 1.0779 (high reached 1.0775 so far).

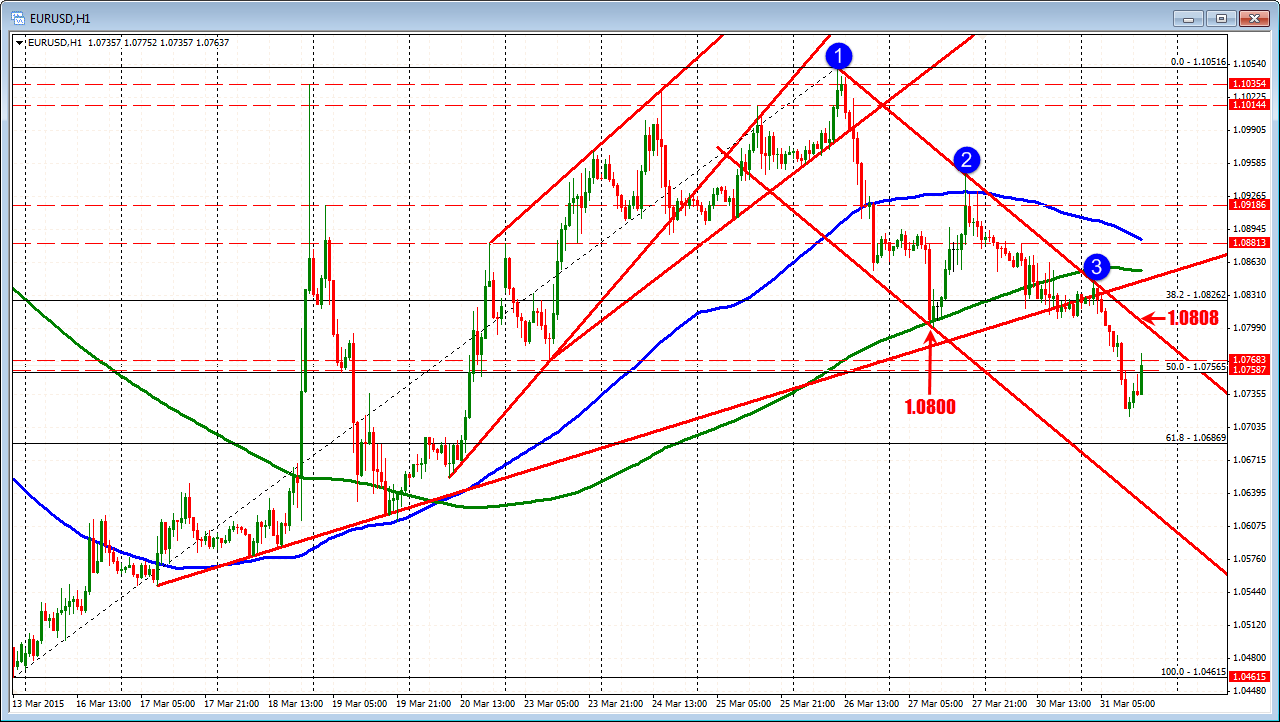

In the process, the price has been able to move back above the 1.0759 level. This is the low price going all the way back to the September 2003 swing low. The price also moved back above the 100 bar MA on the 5 minutes chart at the same area ( see blue line in the 5 minute chart below)

If the sellers are to take back control, they will now need to push the price back below the 1.0759 level (and stay below). Conversely, a move above the 50% will muddy the water further in what was once looking like more a renewed push to the downside for the pair. Now it may be more neutral if the 50% of the days range can be broken.

If there is a continued squeeze higher, the 1.08000/08 area should solicit sellers. This level represents the low from Friday's trading and the topside trend line on the hourly chart (see below). There was not a lot to cheer about in the EU employment rate today. In contrast the US employment picture (released on Friday at 8:30 AM ET), is expected to show 245K new jobs and the unemployment rate remaining steady at 5.5%. This should keep a lid on the EURUSD.

In the meantime, the quarter end flows can lead to choppy trading conditions. The push off the lows is reminding us of that dynamic.