AUDUSD is higher. USDCAD is lower (CAD higher). Oil is higher. Commodities are higher. NZDUSD is lower. HUH?

What the heck is going on with the NZDUSD?

The story should be perfect for the NZDUSD with commodities higher including oil which has been the tail wagging all the dogs. Stocks are higher. The other commodity currencies like AUD and CAD are higher. Yet the NZD and specifically the NZDUSD is lower. It just does not make sense?

Was there a fundamental story?

I don't see any specific story that caused the fall in the early European session.

So what caused the fall.

The answer may just be in the charts.

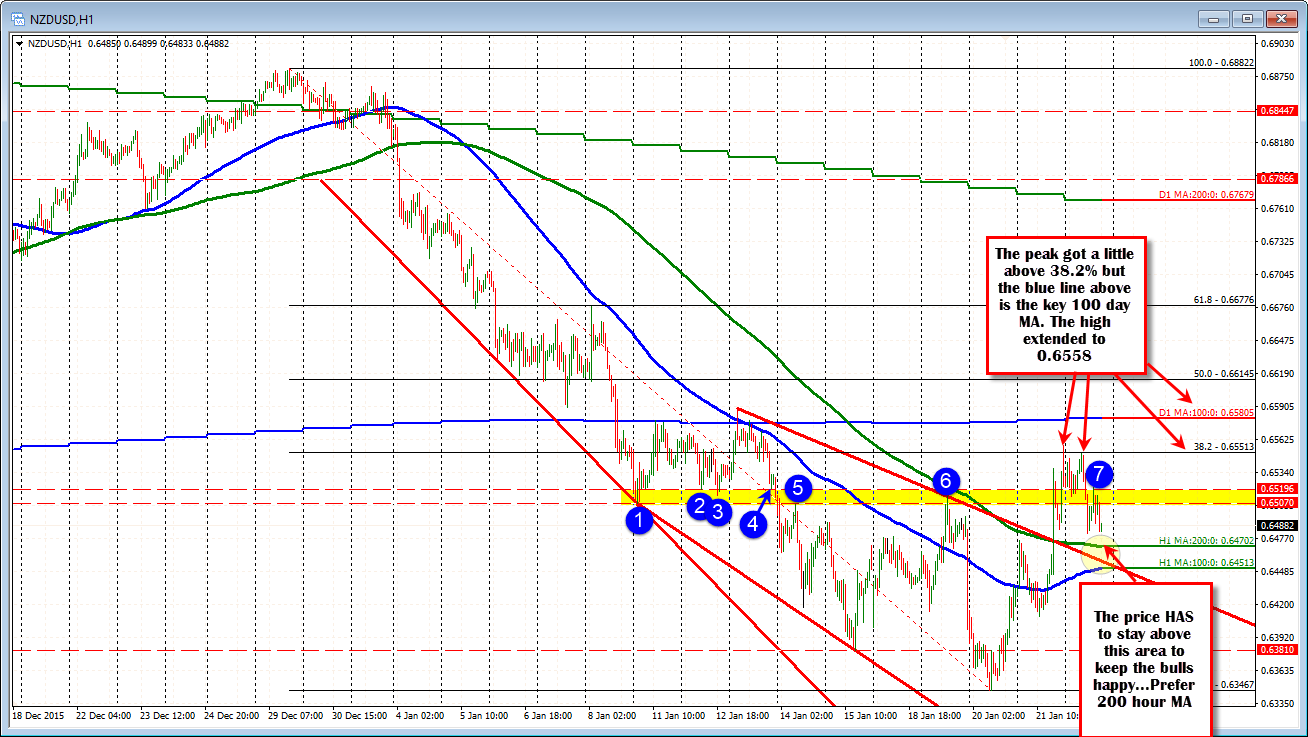

Looking at the hourly chart above, the 38.2% of the move down from the Dec 29 high held (for the most part) on the topside. That level came in at 0.65513. The high yesterday stalled at 0.6556 - a few pips above. Today the high price stalled at the at 0.6550 - just below the 38.2% retracement level. Bearish.

The price move higher was also approaching the key 100 day MA 0.6580). We know that MA to be REALLY important. Note that since breaking below the 100 day MA on January 8, there was one bar where the price traded above the MA line, but that was quickly reversed (on Jan 13). That may have also influenced traders.

The fact is folks....sometimes/many times...when a target level cannot be broken (like the 38.2%) traders will simply lean against it, put a stop above it and see what happens.

What else? Well down lower was another area of importance at the 0.6507-196 (see blue circles). The price moved below this area, corrected up to it and held. Bearish (see blue circle 7 in the chart above).

So what next?

The rubber is about to meet the road. The 200 hour MA (green line in the chart above) was broken for the 1st time since Jan 4 yesterday. If that break is "real" - if there is reason to be bullish, that should hold. If not there is still other support below at 100 hour and trend line, but I think the last of the buyers will be very disappointed and they will throw in the bullish towel.

If the MA holds, the buyers will still have to prove they can get and stay above the levels above at 0.6507-19 and 0.6551, but traders will have the 200 hour MA hold to help their bullish story.

Note however, that should the bulls return and push the NZDUSD higher with the other risk pairs, I would expect some trouble at 0.65805 where the 100 day MA is found. It is just another one of those key levels, that attract a crowd that is interested in defining and limiting risk.

Sometimes market action does not make sense fundamentally and that may confuse you. But technically, the story in the NZDUSD kinda played out the way it was supposed to do. Traders leaned against levels and defined and limited their risk in the process......