Forex news for Asia trading for Thursday 18 March 2021

- Yen crosses lose a little more ground on the BOJ news

- Japanese media report the BOJ will widen its target yield band for 10 year JGBs to plus/minus 0.25%

- US Sec State Blinken says China aggression poses challenge

- Australian PM Morrison says 'major production of AstraZeneca vaccine by the end of the month

- Australian and US 10 yr bond yields are up a touch in Asia

- AUD the leader today after very strong jobs numbers

- What today's white-hot Australian job numbers mean for RBA policy

- PBOC sets USD/ CNY reference rate for today at 6.4859 (vs. yesterday at 6.4978)

- The RBA on the AUD - "Two key fundamental determinants of the exchange rate"

- Korea's central bank says it will take FX stabilising steps (intervention!) if needed

- Australia Feb. employment change +88.7K (vs expected +30K) & unemployment rate 5.8% (vs expected 6.3%)

- BOJ policy review to be released Friday March 19 - the two steps to watch for

- China state TV says the country will not compromise with the US over sovereignty

- New Zealand Q4 GDP recap - two different takes

- Japan's expert coronavirus panel recommends lifting Tokyo state of emergency

- Australia - government's industrial relations overhaul law looks set to fail in parliament

- Dutch election - PM Rutte looks likely to be returned for a fourth term

- Goldman Sachs' "bottom line" on the FOMC

- Brazil's central bank hiked its benchmark rate more than was expected

- New Zealand GDP for Q4 2020 -1.0% q/q (vs. expected 0.2%)

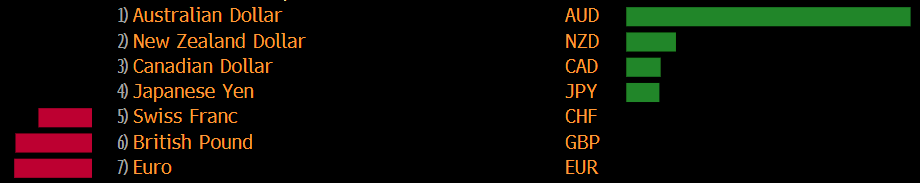

- Bank analyst says favours NZD, CAD, AUD after the dovish Fed

- Lovey-dovey FOMC, main points in summary

- North Korea says new regime in the US 'lunatics'

- China - US summit meeting coming up today, Thursday 18 March 2021

- Trade ideas thread - Thursday 18 March 2021

- Dow and S&P close at record levels. NASDAQ erased its earlier declines

Asia digested the Federal Open Market Committee and Powell by trading relatively limited major FX ranges during the session here today. Bitcoin surged back above US$59K.

News flow was light. There is a high-level diplomatic meeting taking place today, Thursday US time, in Alaska between China and the US, China outlined its hopes for an easing of tensions as a result of the meeting but also expressing low expectations (see bullets above).

On the central bank front there were further Japanese media reports the Bank of Japan is to widen the JGB 10 year yield trading band (from +/-0.2% to+/- 0.25%) and drop its 6 tln yen ETF annual buy target (see bullets above). Yen recovered its earlier losses on the report in the Nikkei press.

The data focus was the labour force figures for February from Australia, which showed well above expectations job bounce-back continuing. Employment now exceeds the pre-pandemic high. Not all the results were positive (see bullets above) but on balance it was an excellent report. As has been noted here at ForexLive (as recently as yesterday, and reiterated today) there is still a note of caution ahead as key elements of fiscal stimulus supporting the job market are being wound back and dropped as of the end of this month. The Australian dollar was a leader on the major FX board for the session, followed by NZD and CAD. Australian 10 year yields rose (as did US, a touch).

For EM news, the Brazilian central bank jacked its benchmark rate higher by 75bps, above the expected rise of 50bps. The Bank also indicated that unless incoming data notably changed ahead the next meeting would also see a 75bps hike.

Japan confirmed Tokyo and its surrounds will exit the state of emergency on Sunday, March 21, as planned.