Forex news for US trading on Feb 12, 2016:

- US January advance retail sales +0.2% vs +0.1%

- Why is the world infatuated by forecasts?

- January 2016 US import prices -1.1% vs -1.4% exp m/m

- Fed's Dudley says key sectors of US economy 'seem to be in good shape'

- Dudley: Recent events will factor into March FOMC decision

- December 2015 US business inventories +0.1% vs +0.1% exp m/m

- February 2016 University of Michigan consumer sentiment flash 90.7 vs 92.0 ex

- Baker Hughes total rig count 541 vs. 571 last week, down 30.

- US stocks end the week on a bullish note

- CFTC commitment of traders report: EUR shorts slashed 24K in the current week

- Support is solid for an ECB deposit rate cut in March - Reuters

- USDJPY moves to new session highs. BOJ Nakaso says: Not approaching limit on bond buying.

- Q&A from BOJ's Nakaso

- Growth forecasts pick up. Atlanta Fed 1Q GDP pegged at 2.7% now

- USDJPY moves to new session highs. BOJ Nakaso says: Not approaching limit on bond buying.

- The yen was easily the top performer this week

- Europe grabs some gains but the week's damage was already done

- It looks like a Friday. It smells like a Friday. It is Friday.

- Risk trades slowly march higher alongside oil

- Michigan's Curtin says consumers are upbeat about the economy long term

- What's next in the BOJ bag of tricks

- The penny is a measure of how well-run a country is

- Never underestimate the spending power of the US consumer

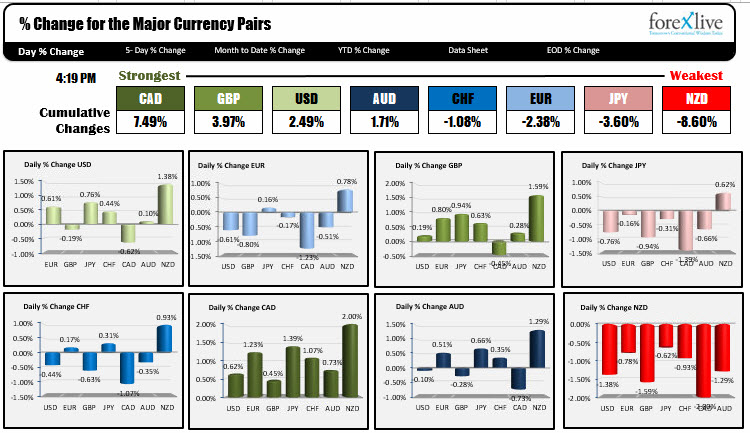

- The strongest and weakest currencies as NA traders enter for the day

Today was a "turn-around Friday". Stocks markets recovered. Oil prices increased by greater than 10%. Gold corrected $8 lower after it's break higher this week. 10-year note yields moved higher by 9 basis points, and in the forex market there were some reversals for some of the currency pairs (USDJPY for one).

The catalyst today was better US retail sales for January which showed the consumer was still strong. The control group which contributes to GDP was up 0.6%. That led to trader thoughts that perhaps "things are not all that bad" after all. The Atlanta Fed GDP estimate for the 1Q was raised to 2.7% from 2.5% (done on Feb 9th), with the consumer leading the way (consumer purchases est 3.2% vs. 3.0% from the last report).

Later Michigan consumer sentiment fell more than expected. One cannot be surprised by that given the stock markets performance since the beginning of the year. Nevertheless, Michigan's Curtin came out and said that consumers remain upbeat about the economy long term. OK..I will take your word for it. Fed's Dudley was also supportive of the economy saying that "key sectors of the US economy seem to be in good shape", but he did say that Fed policy is still "appropriately" still accomodative. Is he saying policy is "appropriate" - as in no March change? All helped toward a "turn around Friday".

In the currencies, the JPY was a currency which was a big mover higher in trading this week. Today, the JPY was weaker, however as the "flight into the relative safety of the JPY" idea started to ease with higher stocks and better data. The USDJPY increased by 0.76% from the close yesterday. Given the 1051 pip trading range over the first nine days of the month (8 of those days lower, with the only up day being a 5 pip gain), it was time for a rebound "just because". It will be curious to see if the pair finds additional support for a correction at the start of the new trading week. Remember 115.55-116.00 above though. That was the breaking point to the downside this week. It should be resistance if there is a rebound early next week.

The EURUSD racheted down in trading today although there was a recovery after failing on a break of an upward sloping trend line. In trading this week, the price moved below the 100 hour MA on Wednesday but quickly rebounded within an hour. Today the price fell below the 100 hour MA (at 1.12708 currently). That moving average will be a key barometer for bullish/bearish in the new trading week.

The GBPUSD traded more like a Friday vs. a turn around Friday. That is, it raced higher into the early European session only to race back down and complete the up and down lap. For the week, the GBPUSD wandered higher and then wandered lower. In fact, going back to this time, the Friday close was at 1.4497. The close is at 1.4500. Closing at the same level as last week is apropo given the price action this week.

The USDCAD has been a strange bird of late (perhaps why they call it the loonie). While oil prices have been pushing 12 year low levels, the USDCAD is well of the highs. So there is something wrong with the oil vs. CAD relationship. Instead of falling, would a rally in oil, get the pair back together? That is, if oil corrected higher would USDCAD fall (CAD get stronger)? For the 1st part of the day, that was not happening. The USDCAD traders seemed intent on leaning against the 200 hour MA for support. Then the level (at 1.3888) was finally broken (oil prices did go up 10% today) and the pair tumbled to the Wednesday lows at 1.3819 (the low extended to 1.3812 before recovering). Although oil prices are up, it is up on talk of a production cut. Is it hot air to get the price up to sell, or does it have substance? That is what makes trading oil and perhaps the USDCAD so difficult. Maybe that is why the pair wants a divorce. It is just too damn hard.

Monday is a holiday in the US and in many parts of England the kiddies are on break, so activity may be light on Monday. Having said that, Sunday/Monday does welcome back China after their week off and their Trade figures along with stock market opening, will be eyed closely on Sunday. Other key events next week include German Zew on Tuesday at 5 AM ET/1000 GMT, UK employment on Wednesday at 4:30 AM ET/0930 GMT. The FOMC meeting minutes on Wednesday at 2 PM ET/1900 GMT, Australia employment on Wednesday, and US CPI on Friday. Oh.....then there is oil and stocks....but you knew that already.

Hava a great weekend.