The oil market melt is coming

July is a good month for oil but the remainder of the year is weak. This could be the last good opportunity to sell crude as oversupply drives the market back down to the lows.

If you're an oil market bear then there is only one question: when? As in, when will more supply hit the market? When will the next breakdown happen?

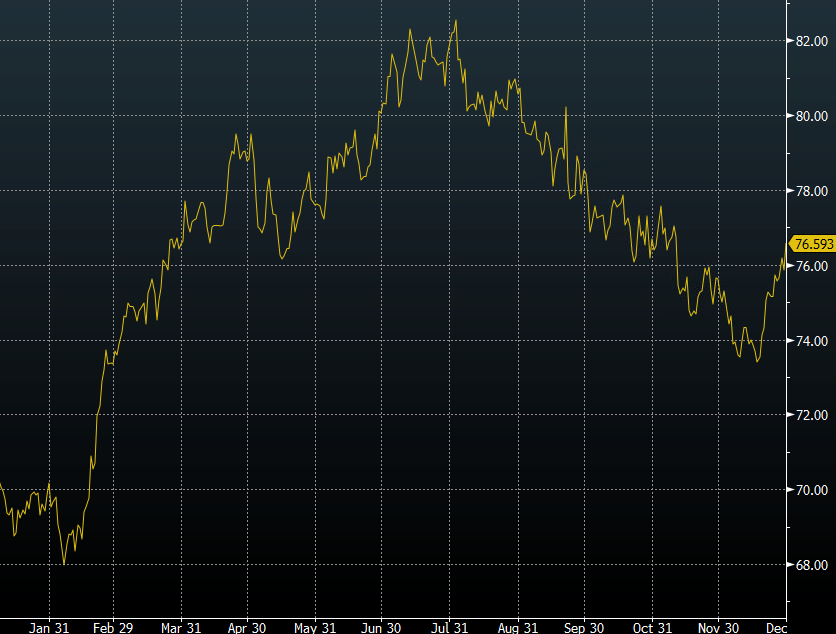

From the look of the chart, we could be close. Yesterday was the lowest close since April and the late-May low is nearby.

WTI crude daily

The major current feature on the chart is the $57-$62 range after the March-April bounce. Ranges are some of my favourite trades because the market gets complacent and the breakouts last longer than anticipated.

So what about the seasonals?

They have (correctly) argued to be patient so far but they turn at the end of July. From July through November is the worst time of the year for WTI crude. If you look at the averages of the past 10-years, crude looks like this.

What I find even more interesting is that if you scale out, you see crude weakness generally hitting in the fall but lately it's been creeping more and more into the late Summer months.

This makes sense.

Crude seasonal strength in August and September in the 90s and early 00s was often related to hurricane season. What's changed? The US doesn't import as much oil through the Caribbean any longer. Imports from Canada and US shale has made the market much less sensitive to hurricane season.

The trend then, is for the weakness to begin earlier and that argues for selling in July.

I'm tempted to sell crude now (and I will if it breaks) but I think the best course of action is to wait for one last bounce to $58-$60 and then hang on for the ride to $50 and below.