PCE data keeps the inflation puzzle muddled

Further signs of a rise in incomes and spending from the US consumer is countered by a fall in prices. That conundrum is not such a bad one for the Fed

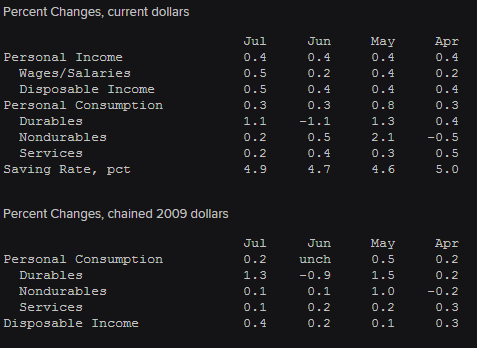

Car sales were said to lead the great spend up, and that's good news being a big ticket item. Spending isn't booming but bucks are being spent and more of them are appearing in the wallets of Mr and Mrs Yank with wages and salaries rising 0.5% vs 0.2% prior, and disposable income up 0.5% vs 0.4%

PCE details

The Fed may be happy to wear some lower inflation while they see an increase in wages and spending. Lower prices making those dollars go a little further is a great pick me up for the average American who's spent the last few years counting the pennies

That gives the Fed the leeway to raise rates even with inflation possibly moving lower

Chuck it all into the mixing bowl and still the path of the US economy is moving in the right direction

US core PCE y/y