Via Bloomberg

This is a piece I came across on Bloomberg reflecting that at the start of the month

Saudi said that they were prepared to do, 'whatever it takes', to support prices. Perhaps Saudi is not quite as resolved as it turns out. The rationale of the article is as follows:

Saudi naturally spoke to the OPEC+ group earlier in the month to try to see what could be done to support oil prices. The progress is as follows:

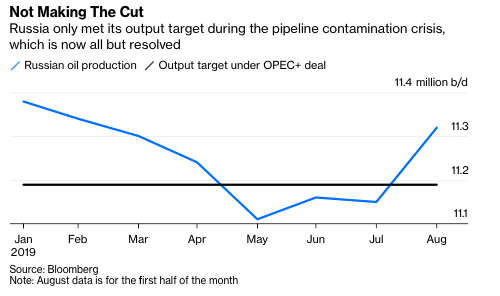

Russia - E-mailed a statement from their energy ministry saying that 'it was 'utterly important to act responsibly', by giving the market only as much oil as was needed. So, Russia then duly goes and oversupplies! Their output target is 11.19 million b/d which they only matched during the Druzhba pipepline crisis.

Iraq: Tanker tracking data by bloomberg suggest that they are pumping the highest level in three months

West Africa : Robust flows

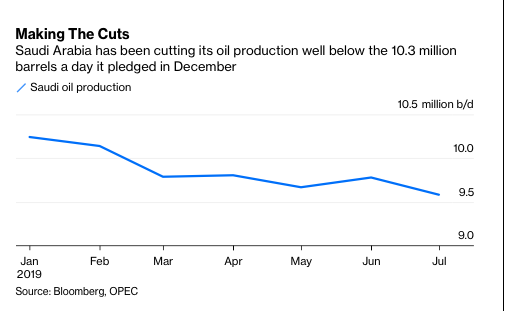

So, without much help, will Saudi alone shoulder the burden of reducing output? They have been keeping their production underneath the 10.3 million barrels a day pledged in December, but they have signalled an unwillingness to solely try and support oil.

The obvious problem with production cuts is that there is always a financial incentive to break them. Saudi Arabia can't be the only player keeping the cut levels. So, the article concludes by saying, 'don't wait for a big production cut from Saudi to rescue oil prices.'. Full Article here