The ultimate measuring stick of a market is how it reacts to news.

When something can’t rally on good news, you have to question if it can rally it all. When something falls despite good news it’s the strongest sell signal of all.

The Australian jobs report smashed estimates today, rising 121K compared to 15K expected. The unemployment rate fell to 6.1% from 6.4%.

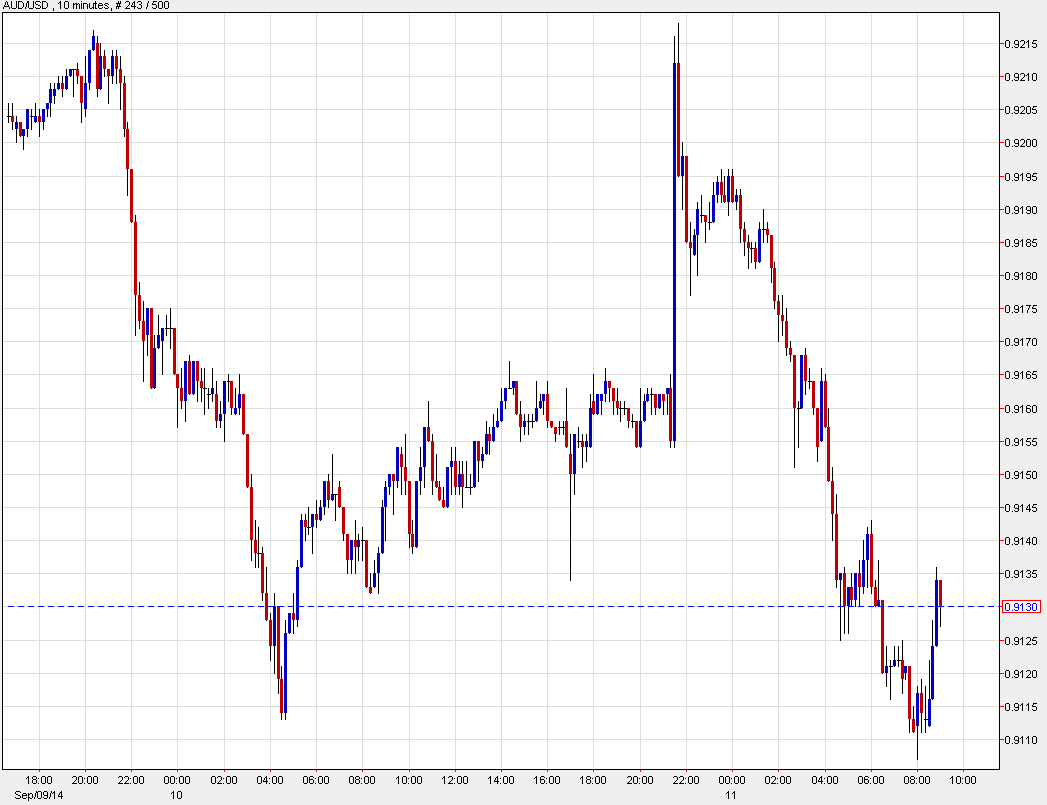

Granted, there are some well-founded criticisms of the seasonality in the report and the job gains were mostly part-time time. But at worst — at worst — the report was still slightly better than expected. Yet after a 60 pip rally to 0.9218, AUD/USD has crashed more than a full cent down to 0.9107, breaking to the lowest since March in the process.

AUDUSD intraday

It’s now abundantly clear that the trend in the Australian dollar is lower. The March-Sept range is broken, the 200-day moving average is broken and there’s not significant support until 0.8900, or even 0.8650.