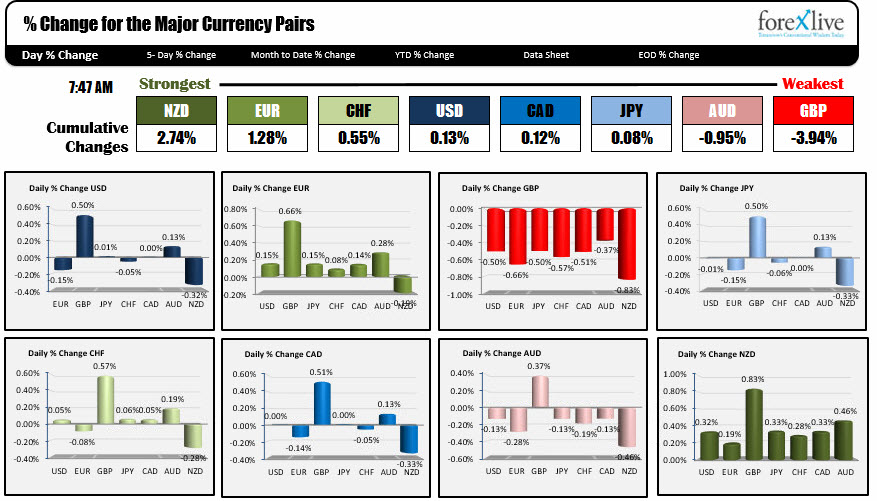

December 7, 2016: The NZD is the strongest: The GBP is the weakest.

As NA traders enter for the day, the NZD is the strongest, while the GBP is the weakest. The USD is little changed vs most major currencies with the exception of the two outliers (GBP and NZD).

The GBP is being influenced by the Brexit. The NZD has been climbing in the London session - along with a rebounding AUD after the surprise GDP numbers at the start of the day. Yesterday the Global Dairy Trade numbers in New Zealand advanced by 3.5%, the 4th increase in a row.

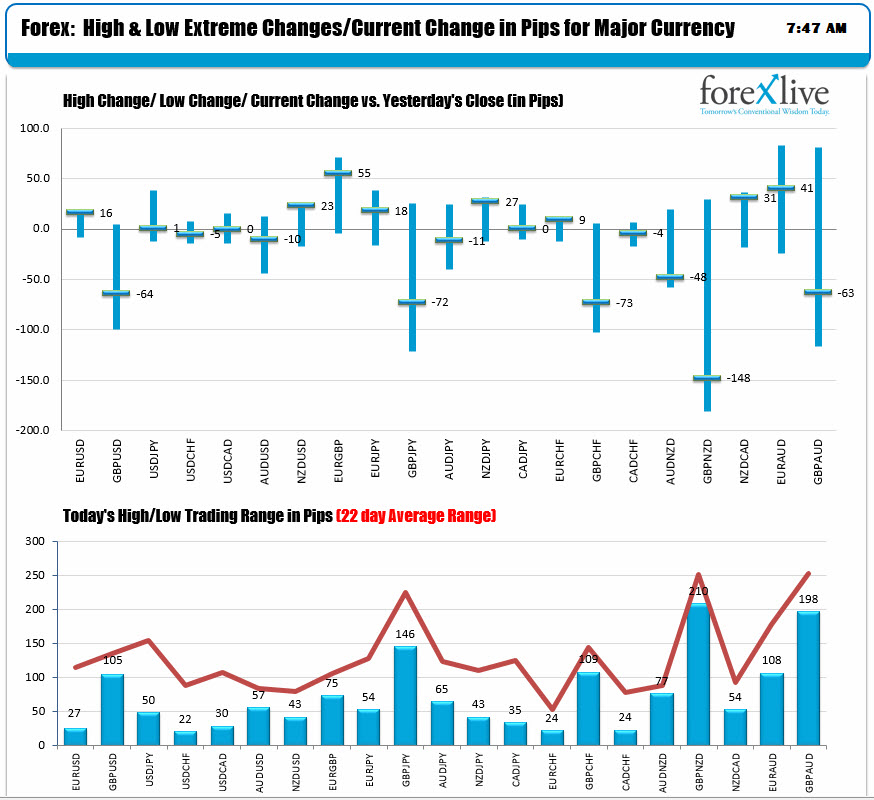

The volatility is low today as well, with most of the focus on the GBP pairs (see blue bars in the chart below). Even so the ranges for the major currency pairs are all very limited.

Today, the JOLTS Job openings will be released at 10 AM with 5500 being the estimate vs 5486 last month.

At 10:30 AM ET, the weekly oil inventory data will be released.

Consumer credit will be released later in the day at 3 PM ET.

The Federal Reserve is in their blackout period before their interest rate decision next Wednesday. So there will be no Fed comments today.

At 10 AM ET, the BOC will release their statement. No change is expected.

At 3 PM, RBNZ Wheeler will be speaking with the title "Some thoughts on New Zealand's economic expansion"

In pre-markets in the US, the S&P futures are down -2.40 points. The Nasdaq futures are down -9.0. The Dow is down -6.0 points.

European stocks are higher with the Dax up 1.28%, the Cac up 0.67%,. Italy continues to advance after the referendum vote ( up 1.42%).

US bond yields are lower:

- ttwo-year note 1.112%, unchanged

- 10 year note 2.389%, -2 basis points

- 30 year bond 3.0599%, -2 basis points

European 10 year bond yields are lower:

- Germany 0.355%,-2 basis points

- France 0.773%,, -3 basis points

- Italy 1.903%, -4 basis points

- UK 1.382%, -4 basis points

Spot gold is trading at $1172 plus $2.50 or 0.22%

crude oil futures are trading at $50.34, $-.60 or -1.2%