The 3.2% rally in the euro was the largest two-day gain since 2009

The move doesn't 'feel' that big because it's a retracement of the recent selloff and back into a familiar range but Predictive Markets says it's the largest move in more than 5 years.

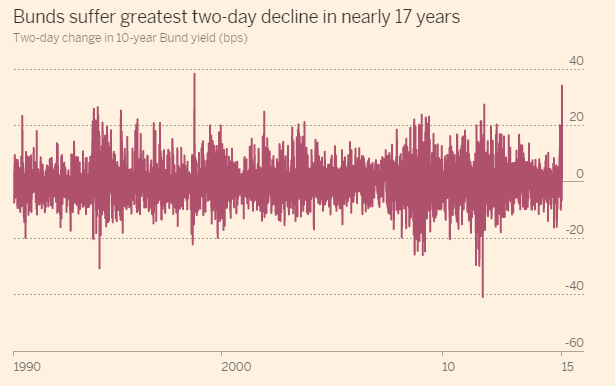

Even more impressive, the FT reports that the two-day 34 basis point jump in Bund yields was the most in almost 17 years. What makes that remarkable is that it's a run from such a low base -- 0.88% from 0.54%; a crushing move in relative terms.

This is the kind of move that needs to be taken very seriously.

Still, it doesn't feel real. Nothing has changed in Europe. Greece punted the June 5 deadline to June 14 and there has been no grand turnaround in economic data. The ECB is still buying 60 billion euros of bonds per month (and more in June if Coeure can be believed).

Either way, it's definitely not a high-conviction market.