A piece from UBS for the weekend, from their most recent Global Macro Strategy

In (very) brief and focusing on the EUR

Central banks are tightening amid falling rates of inflation and declining oil prices

- In the short term, this is triggering a mini dollar rally

- The new macro cycle suggests investors fade short-lived cycles and use them to position for long-term trends ... investors need to identify pockets of "long-term" value

Building our UBS FX Value frameworks ... based on the analysis of G10 current account dynamics

(Note, UBS give a heads up that "No single model gives the complete picture". Good advice indeed.)

Some key results:

EUR cheap, GBP, CAD & CHF expensive

- EUR looks quite cheap even as we adjust for the large output gap in the Euro-area and the structurally large surplus.

- USD & JPY signals are weak and inconclusive.

Back to the short term;

- We have argued that EUR/$ at current levels would face short-term speed limits. Low inflation would underpin a gradualist ECB policy and, against this backdrop, a rapid EUR move higher would force meaningful adjustments to the ECB's inflation forecast.

- Instead, the rapid easing in US financial conditions argues against the market pricing for an upcoming Fed Pause.

- Relative to market expectations, the balance of surprise in the communication of the two main central banks has favoured a mini dollar rally, which could tactically extend.

- This is likely to create better entry levels to buy EUR/$

UBS VIEW:

- We remain bullish EUR/USD from a long-term perspective, but near-term risk-reward has deteriorated, and we would focus positions elsewhere.

- We remain bullish EUR/GBP and EUR/CHF, and would trade continuing growth recovery in the Euro area through long CZK and SEK.

- EUR/USD should grind higher over time, as Eurozone political risk has been reduced, and growth (and policy) resynchronization between the US and Euro area continues.

- Over a longer time horizon we expect EUR/USD to continue rising toward fair value, which we see as being around 1.25. This should be gradual, however.

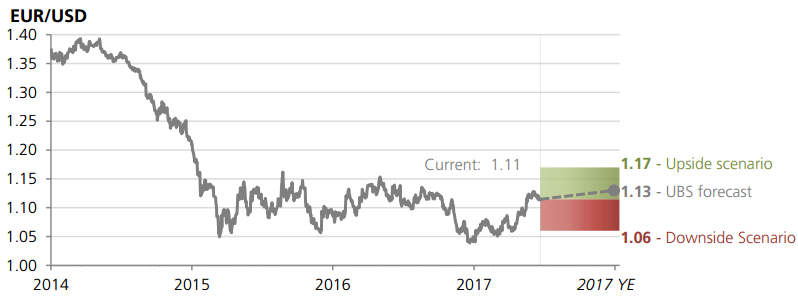

UBS year-end forecast for EUR/USD

--

The weekly note from UBS is long and detailed, this is a summary. of one small part.