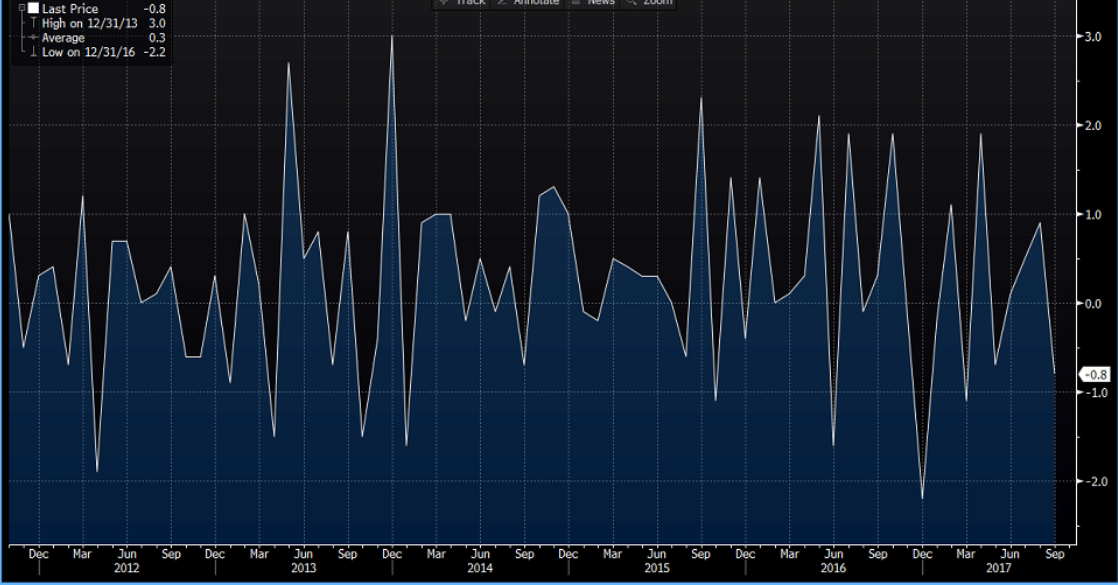

UK Sept retail sales data now out 19 Oct

- +0.9% prev revised down from 1.0%

- yy 1.2% vs 2.1% exp vs 2.3% prev revised down from 2.4%

- core sales ( ex auto fuel) mm -0.7% vs -0.2% exp vs 0.9% prev revised down from 1.0%

- yy 1.6% vs 2.2% exp vs 2.6% prev revised down from 2.8%

Ouch. Bye bye GBP. Happy days. Range trading still though so don't get greedy.

GBPUSD tests 1.3130 support/bids in a flash but currently back to 1.3144. EURGBP 0.8968 from 0.8971 highs.

Says ONS:

- non-food stores provided the greatest downward pressure following growth in August 2017.

- year on year, the quantity bought in the retail sector increased by 1.2%, with non-food (household goods, clothing stores) and non-store retailing all providing growth.

- underlying sales (3M/3M) saw growth of 0.6% down from 0.9% seen in August

- underlying sales (3M/Yr-ago) at 1.5%, lowest since June 2013 (1.2%)

- Retail Sales will contribute 0.03% to Q3 GDP output

- store prices (nsa) continue to rise across all store types and highest y/y

since March 2012 (3.3%) - online sales values rose y/y 1.4% and accounts for approx. 17% of all retail spend

Full report here