Retail sales for August 2019:

- Prior was +0.7% (revised to +0.8%)

- Ex autos 0.0% vs +0.1% expected

- Prior ex autos 1.0%

- Ex autos and gas +0.1% vs +0.2%

- Prior ex autos and gas +0.9%

- Control group +0.3% vs +0.3% expected

- Prior control group +1.0% (revised to +0.9%)

The headline is on the strong side and the prior was revised higher as well. Digging into the control group, that was in-line with estimates and the prior was revised a tick lower. Building material sales rose 1.4%.

Overall, the consumer remains very strong and that is going to give the Fed some pause. A cut next week is a done deal but there's a very good case for Powell to push back against an October cut.

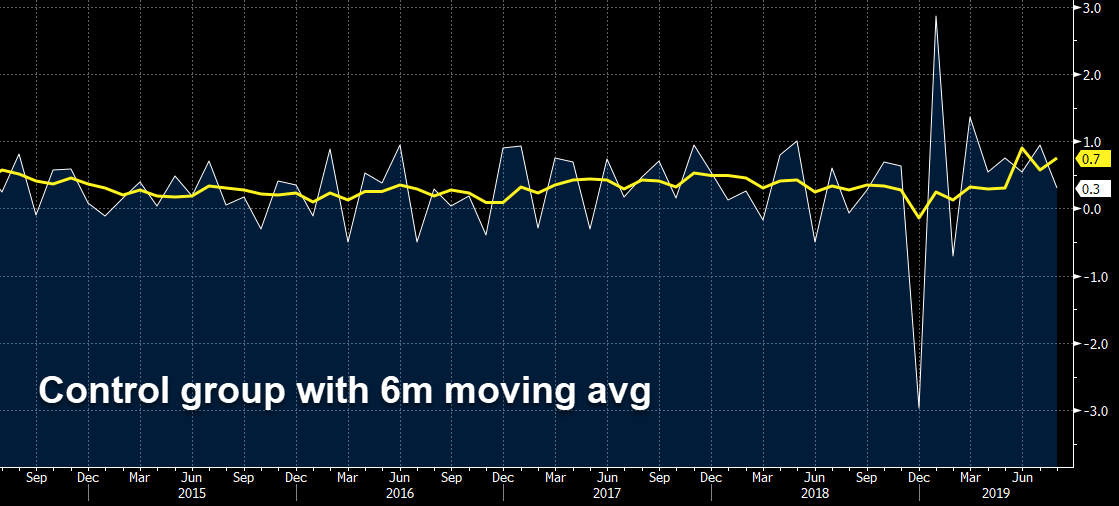

A look at the control group with the 6-month moving average shows how surprising it is that the Fed is cutting.

Bespoke notes: "Control group retail sales (which is the feed for PCE spending estimates at BEA) was up at a 7.9% annualized pace in Q2. With two months of data, it's tracking a 7.1% pace in Q3 or 7.5% annualized on a two-quarter pace. That's just insanely strong."