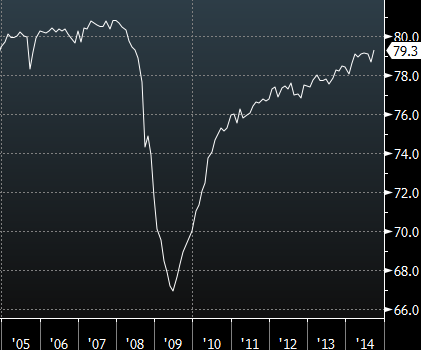

Capacity utilization jumped to 79.3% from 78.7% in data that also showed industrial production rising the most since Nov 2012.

Today’s data on industrial production and jobless claims underscores that the US economy is in solid shape, despite the hiccup in yesterday’s retail sales report that sent markets spiraling.

The worry is that as capacity utilization rises it’s a signal for the Fed to hike. With the rate nearing the 80-81% pre-crisis norm, there’s still some wiggle room but the Fed might not want to wait until this time next year if it continues to rise.

That said, markets aren’t looking past what happens in the next 10 minutes right now and the impact of this report won’t be enough to turn markets.

capacity utilization