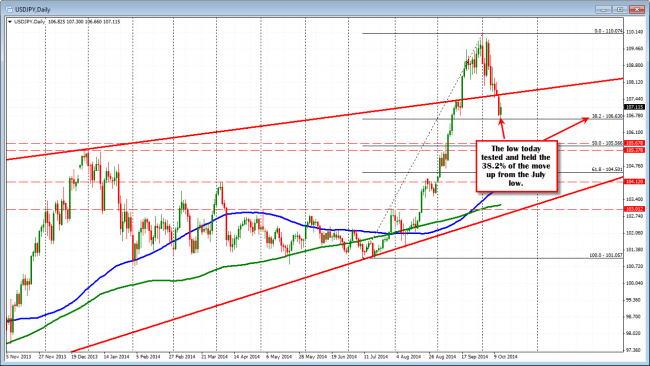

The USDJPY has fallen in trading today on the back of a reaction into the “safety of the JPY”. The low reached has taken the pair to the 38.2% of the move up from the July low (next key target – see post from last week outlining the level for support). The level also corresponded with other recent lows from September. In early NY trading the pair is getting a boost from higher stocks for the 1st time in 4 trading days.

The USDJPY tested and held the 38.2% of the move up from the July 2014 low at 106.63 (low 106.66.)

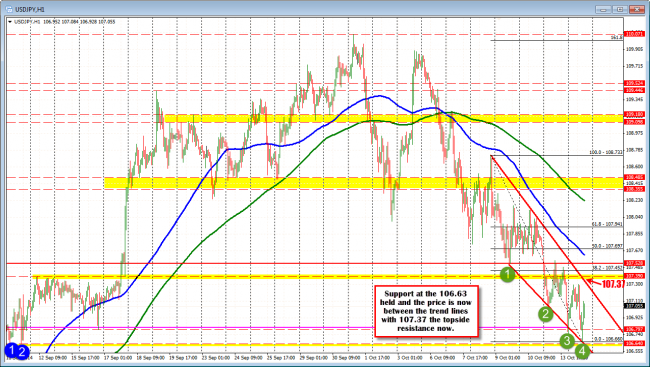

Looking at the hourly chart below, the price also found support along a bottom trend line (connecting recent lows). It was a good level to buy with risk defined and limited.

The price has bounced off the support target and trades between the lower trend line and an upper trend line at the 107.37 level currently. Look for a move toward the 107.37 to solicit sellers now. The stocks are helping, but can that rally continue? The S&P closed below the 200 day MA yesterday for the first times since November 2012. The 200 day MA comes in at 1905.62 today (current price at 1883). Much might depend on what happens there. So keep an eye on the equities.

USDJPY has resistance at the 107.37 level now.

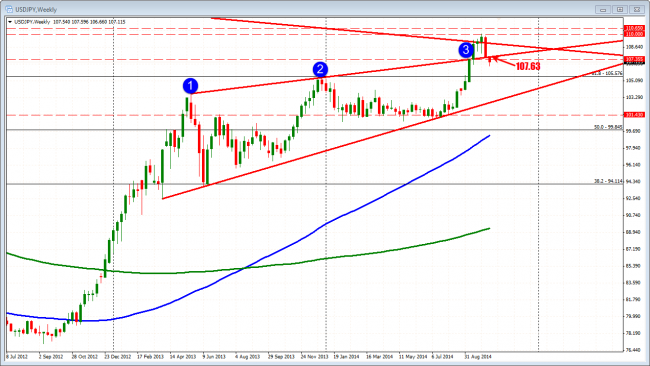

Looking at the weekly chart below, the pair fell below the trend line connecting most recent highs at the the 107.63 level. Going forward, if there is a bigger move higher (say on stocks reversing strongly) this level will be eyed and could be a “line in the sand” for traders. Bullish above. Bearish below.

Keep an eye on the 107.63 this week on corrections. Could be a key level for bulls/bears.