The first release of UK Q2 2014 GDP data is out at the bottom of the hour and the market is expecting an unchanged 0.8% q/q and a slight tick up to 3.1% from 3.0% y/y.

We already know that the BOE is expecting 0.9% for the quarterly number so that surprise won’t be a surprise.

The pound is still leaning towards the sell side after the BOE minutes and Carney’s speech the other day where we heard that the worries over the economy and a potential slowdown through the second half of the year are weighing on the minds of the MPC. That’s taken the pressure off rate rise expectations, but only marginally I feel.

So what number will it take to shift the price today?

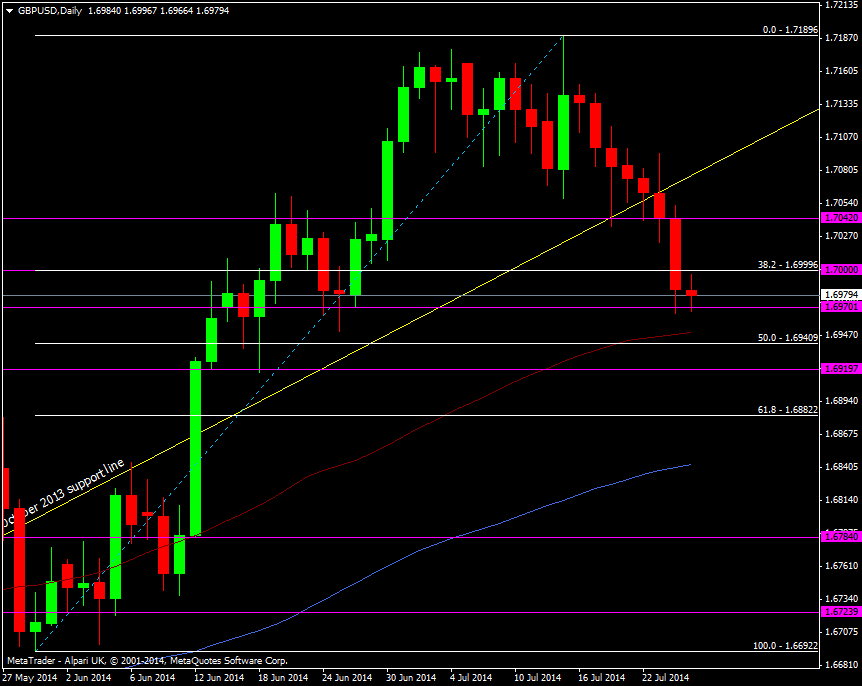

On the upside we will need to see a print of at least 1.0% q/q to turn cable around but that that might not be enough to change course entirely and we’re unlikely to see it rally all the way back towards 1.72 any substantial move up 50/70 pips is likely to find willing sellers. 1.1% or higher and we could have a more meaningful and sustained move towards 1.71.

The chances of a miss are more remote given the fact we’re not doing too bad at the moment. 0.8% or 0.7% might nudge the pound down 30-50 pips and anything less than 0.7% and we’ll be testing 1.69 pretty quickly as the bears take their queue to put some daylight in on their shorts from up top.

Watch the 55 dma and 50 fib of the May/Jul low/hi at 1.6940/50 and support below that at 1.6920

1.7040 is the resistance level to watch on a move up.

GBP/USD Daily chart 25 07 2014