The Australian dollar, as a 'China proxy' trade, can get a boost from bad data out of China, on the basis that there will be more stimulus forthcoming.

That is not the case right now. The data from China was terrible, the jobless rate amongst the young is particularly worrying:

China July Industrial Production 3.8% y/y (vs. expected 4.6%)

The PBOC is adding in (small) monetary stimulus:

But, as I pointed out over the weekend, cheap money is not boosting the economy, liquidity is sloshing around but no-one wants to borrow:

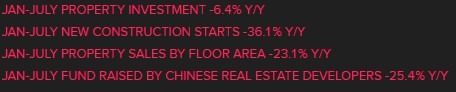

Take on debt to buy property? Why? Prices are falling as the sector implodes under a vast debt load, check this out from earlier:

Take on debt to fund business? Why? At the first sign of COVID the Chinese Communist Party will shutter your business, perhaps for months and months (hello Shanghai!).

---

Meanwhile, the CCP is having a petulant tantrum and firing missiles at Taiwan instead of addressing problems at home.