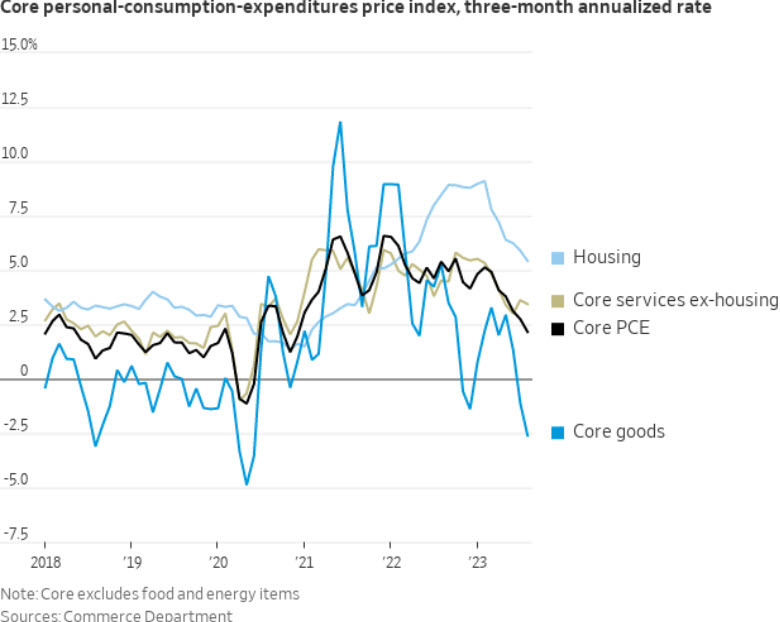

WSJ Fedwatcher Nick TImiraos is highlighting the improvements in inflation in the US and offered up this chart.

Zooming out further, core goods inflation is up just 0.5% y/y while housing rose 7.4% but the latter is a major laggard and will fade rapidly in the coming months (and perhaps further if mortgage rates stay at 7.5%).

The Fed should feel good about where core inflation is headed but will be understandably worried about energy and firming wage demands. The wise thing for them to do is to continue to push a hawkish message (with a hike likely in Nov/Dec) while waiting for some real slack to emerge in the economy.