German DAX a downside exception

The European shares are closing mostly higher. The exception is the German DAX which is trading down about -0.4%. The provisional closes are showing:

- German DAX, -0.4%

- France's CAC, +0.2%

- UK's FTSE 100, +0.2%

- Spain's Ibex, +0.2%

- Italy's FTSE MIB, +0.3%

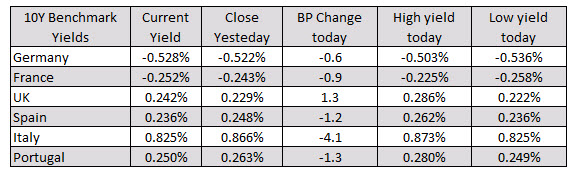

In the European debt market, the benchmark 10 year yields are mostly lower. The exception is the UK 10 year which is up 1.3 basis points.

In the forex, the GBP has taken the lead on the downside. The NZD remains the strongest. The USD - which started the day as the weakest currency - is still lower vs. most of the majors but is now higher vs. the GBP and the JPY

In other markets:

- Spot gold is finding buyers today and has move back above the $1900 level. It currently trades at $1910.36, up $24.59 or 1.3%

- SPot silver is also higher. It is trading up $0.82 or 3.56% at $24.06

- WTI crude oil futures are sharply lower today. It trades down $2.41 or -6.02% at $37.80. After closing back above its 100 day moving average yesterday (at $39.76 currently). The price has rotated back below the level tilting the bias more to the downside.

In the US stock market the snapshot of the major indices currently shows:

- S&P index up 18.82 points or 0.56% at 3381.78

- NASDAQ index up 115 points or 1.04% at 11283.50

- Dow up 100 points or 0.36% at 27881.12